Special Feature

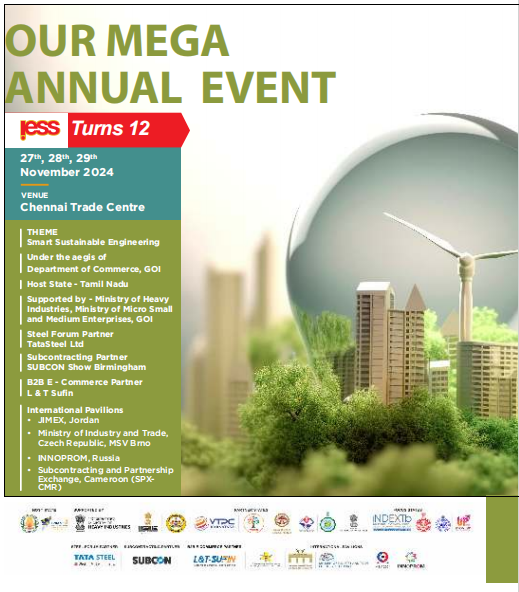

EEPC India’s annual event - IESS (International Engineering Sourcing Show), turns 12! IESS was born with an inbuilt commitment and promise to promote, assist and handhold MSMEs to showcase their engineering goods to their overseas counterparts. EEPC India, for decades, has played a lead role in building the Brand India image by organising exhibitions around the globe.

Over the past decade, IESS facilitated as an intersection for over 3,400 Indian Exhibitors, 86000 + global visitors, orchestrating over 7,000 precise B2B engagements, fostering enduring international trade relationships, 150 + seminars with 750 + speakers, symbolising a melting pot of ideas and innovation, showcasing 150+ engineering product categories, reflecting India’s manufacturing versatility. IESS has showcased around 38 Global Sourcing Meets from 14 countries illustrating India’s commitment to International Trade; Country Specific and State Specific Pavilions alongside Industrial Technology organisations crafting a vibrant exhibition tapestry. We held 23 Vendor Development Meets from 28 Indian organisations that acted as a catalyst for a public-private synergy.

OUR PARTNERS: IESS XII 2024

This 5th IESS in Chennai and seventh time in Tamil Nadu will witness IESS for the second time in one calendar year and for the fifth time in Chennai and seventh time in Tamil Nadu- over November 27-28-29 at Chennai Trade Centre.

• Under the aegis of Department of Commerce, Ministry of Commerce and Industry, Government of India • Host State - Tamil Nadu • Supported by Ministry of Heavy Industries; Ministry of Micro Small and Medium Enterprises, Government of India • Partner States - Karnataka, Madhya Pradesh and Uttarakhand • Focus State: Odisha, Haryana, Gujarat, UP and West Bengal • Steel Forum Partner - Tata Steel • B2B E- Commerce Partner: L&T Sufin • Subcontracting Partner: SUBCON 2025, Birmingham.• International Pavilions: » JIMEX, Jordan » Ministry of Industry and Trade, Czech Republic, MSV Brno » INNOPROM, Russia » Subcontracting and Partnership Exchange, Cameroon (SPX- CMR)

IESS XII edition brings to us four Industry Verticals under four Product Group Heads - Subcontract India, Innovation India, Watteg India and Industromech India –covering over 100 Engineering products to be at display over the three days of the event .

Three Days would witness close to 50 Stalwarts from Leading leagues including TATA Steel, Jaguar and Land Rover (JLR), Arcelor

Mittal Nippon Steel (AM/NS), IIT Madras, CMTI,- GeM, National Institute of Design (NID), E Mobility Society – SSEM; Largest Industrial Fair in Russia – INNOPROM 2025; WACA - Global On-Demand Manufacturing & Supply Chain Solutions Company), around 10,000 Hosted Trade Visitors, around 300 Delegates from over 40 nations, Country/State Sessions, Sessions on Manufacturing Start Ups, Tech Talks, Smart Manufacturing Workshops, Global Sourcing Meets, Exporters Troubleshooting Clinic and much more

SUCCESS STORIES OF PREVIOUS EDITIONS PROVE IESS SUPER JOURNEY (2012-2024)

• 2012 IESS I in Mumbai (22-24 March 2012)

• Around 300 exhibitors, 350 delegates, 6200 visitors, Canada as the partner country, Maharashtra as the partner state.

• 2013 IESS II in Mumbai (14-16 March, 2013): Around 300 exhibitors, 360 delegates 6,800 visitors with Czech Republic as the partner country.

• 2014 IESS III in Mumbai (22-24 January 2014): Around 300 exhibitors, 380 delegates, 7,000 visitors COMESA Region as the partner country and Karnataka as the Partner state.

• 2014 IESS IV Mumbai (16-18 December 2014): Around 300 exhibitors, 390 delegates 7,200 visitors. Poland as the partner country and Gujarat as the Partner State.

• 2015 IESS V Mumbai (24- 26 November 2015): Around 300 exhibitors, 410 delegates 8,500 visitors with Uttar Pradesh as the Partner State.

• 2017 IESS VI Chennai (16-18 March 2017): Around 305 exhibitors, 430 delegates, 9,200 visitors. Russia as the Pa rtner Country, Chennai as Host State, Flanders as Focus Region, 1st Time Tech Pavilion

• 2018 IESS VII Chennai (8-10 March 2018): 320 exhibitors, 445 delegates, over 10,000 visitors. Czech Republic as the Partner Country, Chennai as Host State, Uttar Pradesh and Haryana as Partner States, West Bengal as the Focus State, Flanders as Focus Region.

• 2019 IESS VIII Chennai (14-16 March 2019): 346 exhibitors, 450 delegates, over 12,000 visitors. Malaysia as the Partner Country, Chennai as Host State, Uttar Pradesh as Partner State, Madhya Pradesh, Uttarakhand and Jharkhand as Focus States, Flanders as Focus Region.

• 2020 IESS IX -- First time in Tier II City Coimbatore (March 4-5-6, 2020): Over 410 exhibitors, around 400 delegates, over 10,000 visitors. Malaysia as the Partner Country for the second time, Tamil Nadu as the Host State, Flanders from Belgium as Focus Region and Uttar Pradesh as Partner State – each having their 4th presence and Haryana, Jharkhand, Uttarakhand, West Bengal, Madhya Pradesh, Karnataka, Himachal Pradesh, Gujarat and Jammu Kashmir were the Focus States /UTs. Department of Heavy Industry, Ministry of MSME and Department of Atomic Energy also supported the event. Office of Principal Scientific Adviser to the Government of India was associated with the show

• 2023 IESS X (March 16-17-18): Coinciding with India’s G2O Presidency, the tenth edition of EEPC India’s engineering sourcing show saw around 350 Exhibitors displaying over 149 Products under 5 Verticals to around 300 prospective buyers from across the globe and around 10,000 visitors and a unique feature of Exporters Clinic where exporters queries were dealt on the spot. Tamil Nadu as the Host State – 5th time, Madhya Pradesh, Jharkhand, Himachal Pradesh, Uttarakhand, Jammu & Kashmir as Focus States and UT for the second time, Flanders as the Focus Region for the 4th time; and the Ministry of Heavy Industries, and Department of Scientific and Industrial Research (DSIR), Department of Atomic Energy, National Institute of Design, Governments of Odisha, West Bengal and UP with ODOP scheme, confirmed their support. Tata Steel was the Steel Forum Partner, Bright India group was the Logistics Partner, Union Bank was the Banking Partner, Metalogic was the Conference Partner and 360 TF was the Trade Finance Partner.

• 2024 IESS XI (March 4-5-6) in Coimbatore: Had 192 buyers from 33 countries and 295 Indian Exhibitors displaying over 149 Products under 5 Verticals. 5722 contacts were made, with an average of 34 contacts per exhibitor and 71% of these were new contacts. A total of 147 orders were booked valued at USD 5.19 million and 727 enquiries were generated of worth USD 20.5 million. Nearly 65% of the respondents were able to appoint their distributor agents during the show. 83% of the respondents rated quality of business visitors as excellent. 90% of the exhibitors praised the quality of the seminars. B2B matchmaking between overseas buyers and domestic sellers were successful where over 2200 One to One meetings were conducted. The sample feedback from overseas buyers revealed 93% of them rated the products viewed and also business done and generated by them as excellent and 98% were fully satisfied with the B2B meeting arrangements and 99% with the overall event and 92% buyers and 98% Indian exhibitors would like to again participate in future IESS and other EEPC India events.

SUBCONTRACTING work to qualified partners continues to be an effective strategy for achieving growth in the engineering industry. Buyers and suppliers from all industry sectors need subcontracting partners to exchange and main-tain international benchmark capabilities to remain competitive in a global market. Members of EEPC, particularly those from the MSME sector, would get a stellar opportunity for inclusive growth in SUBCONTRACT India

• Aluminium, Copper and its products

• Casting products& Forging

• Components & parts for Industrial application

• Galvanized Wires, Stainless Steel Wire Mesh

• Industrial Fastener

• Industrial Springs, Spring Coils

• Latches, locking systems and operating elements

• Machined components

• Measuring Instruments, Transducers, Meters, Data Recorder, Calibrators

• Precision Turned Component

• Semi-finished and finished components (Ferrous & Nonferrous)

• Sheet metal components, fabrication & forming

• Steel &Cast Iron Castings, Steel Bars, Rods, Structures

• Steel Fittings & Flanges

• Steel Mills equipment and supplies

• Steel Wires, Coils, Bars, Pipes and Tubes

• Systems/sub-assemblies

• Resin Transfer Moulding (RTM), Injection Moulding, Compression Moulding, Pultrusion

• Engineering Plastics & Moulded Parts

Raw Materials• Material for production of

industrial parts in the form of sheets, coils, bars, tubes, wires

• Enamelled Winding Wires

Testing, Measuring and Analytical Equipment• Mechanical and Electrical testing Components

• Quality control and analytical equipment

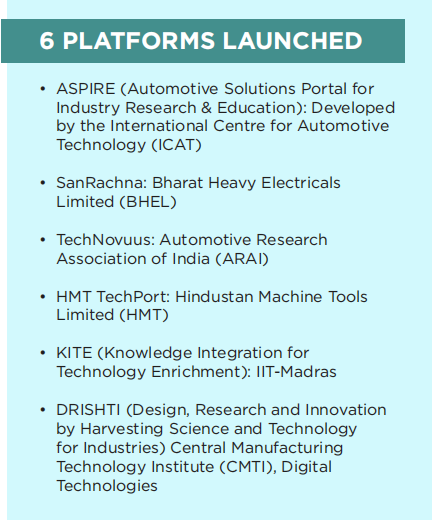

INNOVATION India focuses on engineering start-ups, industrial technologies, technology transfer and promotion in the global market. With eminent technology providers, CSIR Labs, NID, IITs and other similar institutions presenting their capabilities, this platform would go a long way in boosting innovative entrepreneurship. The main purpose of INNOVATION India is not just to present solutions and inventions but also to forge meaningful business connections and collaborations for the growth of innovation ecosystems across globe.

• Advanced Composites

• Advanced Manufacturing & Industrial Internet of Things (IIoT)

• Advanced Materials Technology

• Aerospace Technologies, Electronics and Systems

• Air Pollution Control

• Augmented Reality

• Carbon Reduction Technologies

• Defence & Aerospace Technologies

• Drones Manufacturing & Industrial Applications

• E Mobility

• Frugal Innovations

• Green Manufacturing/Technology

• Healthcare and Medical Technologies

• Hydrogen Fuel Mobility

• Industrial Design & Stimulation Testing

• Innovative Product Start ups

• New Science and Technology Initiatives & Policy Research

• Occupational Health and Safety Technologies

• Other R&D & Technologies for Engineering Manufacturing

• Precision Mechanical Systems

• Product Design & Development

• Prototype Design and Simulation Testing

• R&D Services & Facilities

• Rapid Prototyping, Machining & Tooling

• Renewable Energy Technologies

• Research Labs & Academic Research Institutes

• Robotics & Mechatronics

• Smart Manufacturing

• Solid and Hazardous Waste Management

• Start-ups & Innovators

WATTEG India is an initiative in connecting India’s fast-growing energy and electrical sector with the regional and global requirements particularly in view

of rapid urbanization and industrial growth. This premier platform focuses to combine the energy and electrical

sectors with its allied equipment industries into a sustainable energy transition. With the right mix of traditional and renewable energy, both for transmission, distribution, WATTEG aims to achieve the motto of the event “#Smart-SustainableEngineering.

• Conductors

• Control Panels

• Electric Motors

• Electrical Cables& Wires

• Electrical Insulation Materials

• Electrical Power Tools

• Electrical Transmission & Distribution Equipment

• Engine Dynamo Meters & Accessories

• Generators & Diesel Engines

• Industrial and Domestic Batteries

• Lights and Fittings

• Lugs, Cable Rings

• Panel Boards

• Refrigeration and Air Conditioning

• Renewable Energy- Wind, Solar, Small Hydrocarbon, Biogas etc.

• Smart Home Appliances

• Stampings

• Switchgears

• Transformers

• Turbines and Parts

• Winding Wires

INDUSTROMECH India include a diverse range of industrial machines, equipment, accessories and devices which are part of larger industrial and manufacturing projects. With more than 10000 domestic visitors, INDUSTROMECH would provide an unique opportunity to Indian engineering industry to be a part of global and regional value chain.

• Blowers and Fans

• Chemicals & Petrochemicals Industry

• Clean & Waste Management

• Construction

• Cutting Tools

• Dairy Industry

• Electroplating and Galvanising

• Extrusion products

• Fabrication

• Fasteners & Accessories

• Furniture, Fixtures and Fittings

• Hand/Power Tools & Accessories

• Heat Treatment

• Heavy Engineering

• Hoists, Cranes& Accessories

• Hydraulic Press & Hydraulic Cylinder

• Hydraulic Systems& Pneumatics Systems

• Industrial Boilers and Furnace

• Industrial Cooling Towers,Systems and Heat Exchangers

• Industrial Electronics

• Industrial Humidification Systems and Fans

• Industrial Packaging Equipment Machinery & System

• Logistics Equipment & System

• Machine Tools and Accessories

• Material Handling Equipment & Storage Systems

• Metal &Metallurgical Equipment, Technology

• Metal Working Machines & Accessories

• Moulds & Dies Production Machinery & Accessories

• Pipes and Tubes

• Precision Engineering and Turned Components

• Pumps, Valves and Parts

• Steel Rolling Mills

• Tea & Coffee Processing

• Textile Mills

• Welding & Cutting Equipment & Accessories

• Wood and Plywood

• Industry Services

• Safety equipment and products, maintenance equipment

• Engineering Consultancy, Services-Consultancy and Project Management

• Outsourcing product development

Subcontracting (or ancillarisation) is an important feature of modern organization of manufacturing industry. India embarked upon the path of economic liberalisation from 1991 onwards, although trade sector liberalisation started in the middle of the 1980s.

One of the crucial aspects of economic liberalisation is freeing the industrial sector from industrial licensing for a majority of industries. The issue of subcontracting arises for two main reasons - one is that largescale industries reap the benefits of a small permanent labour force through subcontracting, which helps them to adjust the fluctuating demand more easily. Secondly, subcontracting may also prove to be an opportunity for the small-scale sector to face global competition through their association with some large-scale industries, national or foreign. Subcontracting, otherwise known as contract manufacturing or private manufacturing, is the process of outsourcing either a part or all of your manufacturing to an external company. The rule of third-party manufacturing comes in to process under Subcontracting. There are plenty of reasons behind the issue that includes:

(a)increasing production

(b)allocating capital more efficiently

(c)responding to sudden demand spikes

(d)reducing labour costs

Employing external manufacturing through subcontracting can increase the output of the product without the added risk of a large debt. A manufacturer can prefer to think of subcontracting as a stepping stone in the process of accumulating the capital required to build more in-house production capacity. There are plenty of factors that you need to consider when it comes to subcontracting.

Subcontracting Process:

1. Quality standards need to be established and agreed upon. 2. The next step is to iron out important logistical details, such as coordinating the production schedules for instance. 3. Then the manufacturer needs to track inventory levels and follow the manufacturing operations across multiple locations, including the manufacturers’ partner’s warehouse — these can prove challenging without the right tools. 4. Last, but not the least, the manufacturer needs to set up quality control checks for the finished products from the subcontractor.

Benefits of Subcontract Manufacturing:

• No overhead in setting up new manufacturing facilities • Often cheaper since the subcontractors can produce the goods at a lower cost • Easier to scale up or scale down production in response to demand • Frees up resources to focus on core competencies

Disadvantages of Subcontract Manufacturing:

• Lesser control over the process of manufacturing • Higher coordination and quality control overheads • Other softer overheads such as invoicing and accounting

Thus, Subcontracting is practiced by various industries. For example, manufacturers who make a number of products from complex components subcontract certain components and package them at their facilities. In case of engineering section, subcontracting takes place in different stages of production, varying from the path of supplying the raw materials to the final stage of production.

INDIA’S ASTRONOMICAL POTENTIAL AS A MANUFACTURING HUB

India’s manufacturing sector reached a 16-year high in March, with the HSBC Manufacturing Purchasing Managers’ Index (PMI) rising to 59.1, driven by strong increases in output, new orders, and job creation across various goods sectors. India has the capacity to export goods worth US$ 1 trillion by 2030 and is on the road to becoming a major global manufacturing hub. With 17% of the nation’s GDP and over 27.3 million workers, the manufacturing sector plays a significant role in the Indian economy. Through the implementation of different programmes and policies, the Indian government hopes to have 25% of the economy’s output come from manufacturing by 2025.

India now has the physical and digital infrastructure to raise the share of the manufacturing sector in the economy and make a realistic bid to be an important player in global supply chains.A globally competitive manufacturing sector is India’s greatest potential to drive economic growth and job creation.

Some Encouraging Pointers

• India is gradually progressing on the road to Industry 4.0 through the Government of India’s initiatives like the National Manufacturing Policy which aims to increase the share of manufacturing in GDP to 25 percent by 2025 and the PLI scheme for manufacturing which was launched in 2022 to develop the core manufacturing sector at par with global manufacturing standards.

• FDI in India’s manufacturing sector has reached US$ 165.1 billion, a 69% increase over the past decade, driven by production-linked incentive (PLI) schemes. In the last five years, total FDI inflows amounted to US$383.5 billion.

• India is planning to offer incentives of up to Rs. 18,000 crore (US$ 2.2 billion) to spur local manufacturing in six new sectors including chemicals, shipping containers, and inputs for vaccines.

• India’s mobile phone manufacturing industry anticipates creating 150,000 to 250,000 direct and indirect jobs within the next 12-16 months, driven by government incentives, and increased global demand. Major players like Apple and its contract manufacturers, along with Dixon Technologies, are expanding their workforce to meet growing production needs.

Due to factors like power growth, long-term employment prospects, and skill routes for millions of people, India has a significant potential to engage in international markets. Several factors contribute to their potential. First off, these value chains are well positioned to benefit from India’s advantages in terms of raw materials, industrial expertise, and entrepreneurship. Second, they can take advantage of four market opportunities: expanding exports, localising imports, internal demand, and contract manufacturing. With digital transformation being a crucial component in achieving an advantage in this fiercely competitive industry, technology has today sparked creativity. Manufacturing Sector in India is gradually shifting to a more automated and process driven manufacturing which is expected to increase the efficiency and boost production of the manufacturing industry

WHY SUBCONTRACT MANUFACTURING BUYERS NEED TO ATTEND IESS

IESS would bring together the Global Procurers under the same roof with intensive ‘Sourcing Meets’ – Global Sourcing Meets, Sessions on Manufacturing Start ups. This makes it a must attend event for subcontract manufacturing buyers from all industry sectors, to source suppliers, benchmark capabilities, and secure contracts in order to remain competitive in a global market. The event will help identify, procure and benefit from the low-cost advantage of MSMEs in machining, sheet metal working, engineering, material development, design, prototyping, screw cutting, surface treatment, testing etc. As a platform for tier 2-3 precision engineers and component suppliers to showcase their strengths to OEM’s and Tier 1 manufacturers.

India ranks third among the most innovative lower-middle-income economies in the world. Rising per capita income in India will bring a boom in R&D investment in the country with multiple foreign players shifting R&D bases to India. R&D investment and multiple government policies have helped Indian companies overcome tight competition with affordable products internationally. India plans to move forward with developing its science and technology sector by collaborating with other countries. India has active bilateral science and technology (S&T) programs of cooperation with more than 45 countries, including dedicated programs for Africa, ASEAN, BRICS, EU and neighbouring countries. In 2021, India also collaborated with Denmark and agreed to a five-year plan to implement a green strategic partnership for enhancing partnerships in various areas, including science and technology.

India is aggressively working towards establishing itself as a leader in industrialization and technological development. Significant developments in the nuclear energy sector are likely as India looks to expand its nuclear capacity. Moreover, nanotechnology is expected to transform India’s pharmaceutical industry. The agriculture sector is also likely to undergo a major revamp with the government investing heavily in a technology-driven green revolution. The Government of India, through the Science, Technol ogy and Innovation (STI) Policy-2013, among other things, aspires to position India among the world’s top five scientific powers.

Industry Contacts

• National Academy of Sciences • Indian Science Congress Association • Indian National Science Academy • Indian Academy of Sciences • Department of Science and Technology • Indian National Academy of Engineering

Major Indian States for Science and Technology

• Maharashtra • Gujarat• NCR • Karnataka • Tamil Nadu • Telangana • Andhra Pradesh • Madhya Pradesh

GOVERNMENT INITIATIVES TO PROMOTE SCIENCE & TECHNOLOGY

• In October 2023, Union Minister Dr. Jitendra Singh launched state-of-art latest National Survey Network; the nationwide “Continuously Operating Reference Stations” (CORS) Network that will be operated by the Survey of India. The Survey of India has set up more than 1,000 CORS stations across India.

• Launching National Policy on Research and Development and Innovation in Pharma-MedTech Sector in India and Scheme for promotion of Research and Innovation in Pharma MedTech Sector (PRIP) in September 2023.

• The Indian Space Policy-2023: It was approved by the Cabinet Committee on Security on April 6, also permits non-government entities (NGEs) to offer national and international space-based communication services, through self-owned, procured or leased geostationary orbit (GSO) and non-geostationary satellite orbit (NGSO) satellite systems. NGSO is a reference to low earth orbit or medium earth orbits that are home to satellites providing broadband internet services from space.

• The policy also encourages NGEs to establish and operate ground facilities for space object operations, such as telemetry, tracking and command (TT&C) Earth Stations and Satellite Control Centres (SCCs).

• In 2023, Strengthening, Upscaling & Nurturing Local Innovations for Livelihood (SUNIL) Pro-gramme, Technology delivery & enterprise creation model for improving the efficiency of the livelihood system. Technology interventions for Addressing Societal Needs (TIASN), Capacity Building of Community-based organizations (CBOs), NGOs, Knowledge Institutions (KI) & Social Start-ups.

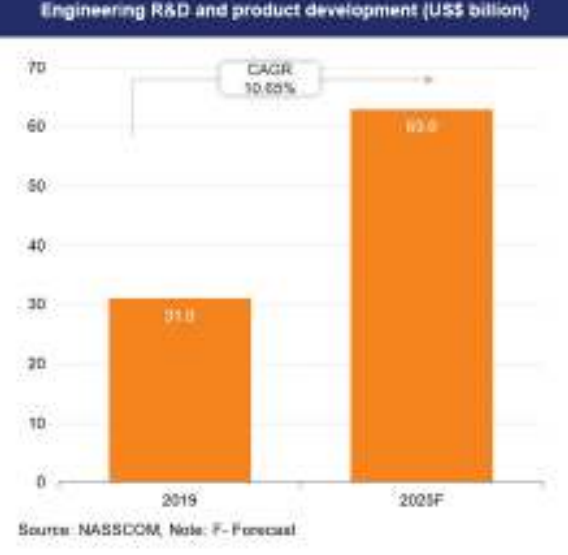

• The engineering R&D and product development market in India is forecast to post a CAGR of 12% to reach US$ 63 billion by 2025, from US$ 31 billion in 2019.

• As per the Economic Survey 2022, India’s gross domestic expenditure on R&D (GERD) as a percentage of GDP stood at 0.66%.

• 143,695 startups (as of August 2024) from 350 startups in 2014. India has witnessed an investment of over Rs. 1,000 crore (US$ 120.21 million) in Space Startups in the last nine months between April to December 2023.

• India’s gross expenditure on R&D (GERD) as a percentage of GDP has remained stagnant at around 0.7% for about a decade, lower than Brazil (1.16%), South Africa (0.83%) and others.

• IT spending in India will grow 10.7% YoY to reach US$ 124.6 billion in 2024, as forecasted by Gartner. India’s bioeconomy was valued at US$ 137 billion in 2022 and aims to achieve US$ 300 billion mark by 2030.

• In FY21, the science and technology sector added 1,497,501 employees, becoming India’s top employment generator

• Under the Interim Budget 2024-25, the government announced an allocation of Rs. 8,029 crore (US$ 966 million) to the Department of Science and Technology and Rs. 16,604 crore (US$ 2 billion) to the Ministry of Science and Technology.

In the Interim Budget 2024-25, the government announced corpus of Rs. 1 lakh crore (US$ 12 billion) to promote Innovation and StartUps coupled with a new scheme for Deep Tech StartUps in Defence. According to Commerce and Industry Minister, Mr. Piyush Goyal, the Indian patent office has granted the “highest” number of 41,010 patents till November 15th, 2023.

The Indian Patent Office has crossed the one lakh mark for the first time this year, with 1,01,311 patents being granted by the department between March 15, 2023, to March 14, 2024, reflecting the government efforts to enhance the intellectual property rights framework.

India is ranked in 7th position in terms of Resident Patent Filing activity in the world. In India, there are more than 1,580 Global Capability Centres (GCCs), where companies can outsource their product development and receive product engineering services, with the GCC market size crossing US$ 46 billion (as of FY23). These GCCs are home to some of the largest companies, many of which have their largest or second-largest R&D centres located in the country.

Accenture offers a framework for assessing the economic effect of AI for selected G20 countries in its latest AI research studies and forecasts that AI will raise India’s annual growth rate by 1.3% by 2035. India’s National Artificial Intelligence Strategy prepared by NITI Aayog outlined a way forward to harness the potential of Artificial Intelligence (AI) in different fields. State University Research Excellence (SERB-SURE) to create a robust R&D ecosystem in state universities and colleges; Fund for Industrial Research Engagement (SERB-FIRE) to support research and development to solve critical problems that are relevant to industries in a public-private partnership mode.

The Government of India has de-licensed the Electrical Machinery industry and has allowed 100% foreign direct investment (FDI) in the sector. EEPC India, under the aegis of Ministry of Commerce and Industry, Government of India, has identified the Electrical Machineries &Equipment sector as one of the four focus sectors under ‘Brand India Engineering.’ ‘Brand India Engineering’ is an initiative being implemented by EEPC India under the aegis of the Ministry of Commerce and Industry, Government of India, in close cooperation with the industry to enhance Indian engineering exports, by highlighting and showcasing Made in India products and their capabilities in the global market. The initiative involves a 360-degree approach in promoting the branding of Indian engineering products. It is expected to catapult India’s status in engineering capabilities, by highlighting India’s competitiveness, credibility & service commitments in engineering sector.

India Brand Equity Foundation (IBEF), a Trust established by the Department of Commerce, Indian Electrical & Electronics Manufacturers’ Association (IEEMA) and EEPC India are steering the campaign in coordination with national associations & industry stakeholders in the Electrical Equipment sector.

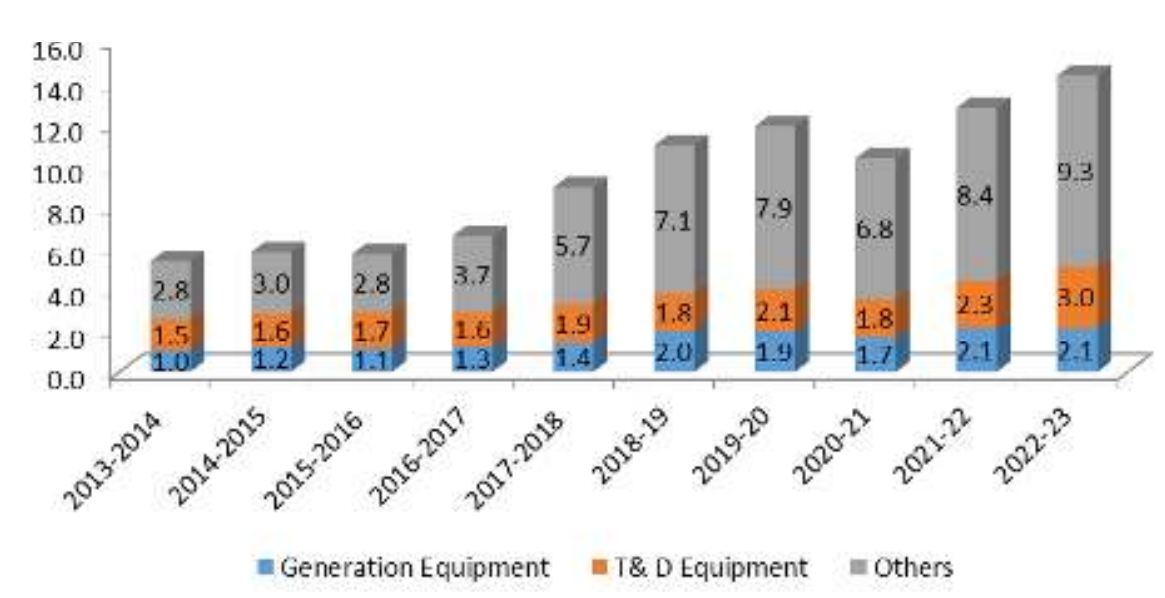

ELECTRICAL MACHINERY EXPORTS ON THE RISE: ENCOURAGING STATISTICS

India’s exports of Electrical Machinery and Equipment rose to USD 14.3 billion in 2022-23 from USD 5.3 billion in 2013-14 with a CAGR of 11.6%. The following diagram depicts the year-on-year growth in India’s export of electrical machinery &equipment.Fig. 2: India’s Export of Electrical machinery &equipment (US$ billion).

Sub sector wise Generator ranks occupies 11.1% of India’s total export of Electrical machinery as on 2022-23. Turbines share 2.2% of export basket followed by Cables & Conductors (8.8%) and Transformers (5.7%) during the same. The other segment of Electrical machinery and equipments barring Generation equipments and T&D equipments, which have remarkable export prominence are Turbo jets and converters. The ‘other’ segment though not very vast in size consists mainly of MSME players, catering the global market. India’s export of HS code 841112 (TURBO-JETS OF A THRUST>25 KN) and HS code 85044090 (STATIC CONVERTERS) were 18.8% and 5.6% respectively in 2022-23.

India’s global export of Electrical Machinery - Sub Sector wise

|

Values in US$ million |

Sub-Sectors |

2018-19 |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

|

Generation Equipment |

Boiler |

460.9 |

482.4 |

239.4 |

189.0 |

212.93 |

|

Turbine |

445.0 |

440.0 |

453.3 |

384.2 |

308.48 |

|

|

Generator |

1064.7 |

1027.3 |

984.2 |

1550.2 |

1593.49 |

|

|

T& D Equipment |

Transformers |

564.1 |

539.8 |

501.1 |

688.2 |

821.5 |

|

Capacitors |

132.8 |

114.0 |

119.6 |

150.4 |

153.38 |

|

|

Switch gear |

98.5 |

114.3 |

137.1 |

147.3 |

162.83 |

|

|

Cables & Conductors |

669.8 |

909.2 |

702.0 |

969.6 |

1264.39 |

|

|

Transmission lines |

277.8 |

326.4 |

329.9 |

270.1 |

511.32 |

|

|

Energy Meters |

90.9 |

51.9 |

38.0 |

46.0 |

43.26 |

|

|

|

Others |

7143.8 |

7873.6 |

6831.5 |

8365.5 |

9262.2 |

India’s top five export destination in the last 3 years sub sector wise. USA ranks as the numero uno destination of India’s export of Generation Equipments, importing almost 26 percent of India’s export of the same in 2022. The share of other top nations are Germany (6.1%), Poland (4.2%), France (4.0%), and Spain (3.7%).

In case of Transmission & Distribution (T&D) equipment also USA ranks as the numero uno destination of India’s export of the same, importing 26 percent of India’s export of the T&D equipment. The shares of other top nations are UK (5.8%), Bangladesh (5.6%), Germany (4.1%) and UAE (3.8%).

Global major suppliers of Electrical machinery & equipments in the world market and viz-a-viz India’s rank in 2021 sub sector wise Indian electrical and machinery equipment boasts of a diversified, matured and strong manufacturing base backed by a robust supply chain. Rugged performance design of equipment to meet tough network demand

|

Values in US$ million |

Generation Equipment |

||

|

Top 5 Export Destinations of India |

2020 |

2021 |

2022 |

|

World |

2879.0 |

3800.0 |

4212.0 |

|

USA |

943.4 |

1007.7 |

1077.1 |

|

Germany |

158.0 |

255.4 |

258.9 |

|

Poland |

43.4 |

254.2 |

176.1 |

|

France |

90.1 |

129.2 |

166.5 |

|

Spain |

28.8 |

76.4 |

157.6 |

|

Values in US$ million |

T& D Equipment |

||

|

Top 5 Export Destinations of India |

2020 |

2021 |

2022 |

|

World |

2909.1 |

3733.5 |

4739.4 |

|

USA |

456.4 |

783.2 |

1228.9 |

|

UK |

135.4 |

216.3 |

273.5 |

|

Bangladesh |

145.3 |

114.0 |

263.7 |

|

Germany |

107.4 |

155.6 |

196.1 |

|

UAE |

153.1 |

147.4 |

180.6 |

and presence of major foreign players, either directly or through technical collaborations with Indian manufacturers is a testimony of unique advantages India holds in this sector. With state-of-the-art technology in most sub-sectors at par with global standards, Indian electrical equipment is exported globally. The major export products are Rotating Machines (Motors, AC Generators and Generating Sets) & Parts, Switchgear and Control gear, Transformers & Parts, Cables, Industrial Electronics, Boilers & Parts, and Transmission Line Towers etc. The following tables show the rank of India as a global supplier of Generation equipment and T&D equipment in 2022.

|

Values in US$ billion |

Generation Equipment |

|

|

Rank |

Exporters |

2022 |

|

|

World |

153.3 |

|

1 |

China |

29.8 |

|

2 |

USA |

17.1 |

|

3 |

Germany |

14.2 |

|

4 |

Japan |

8.3 |

|

5 |

Italy |

8.3 |

|

6 |

Mexico |

6.1 |

|

7 |

UK |

5.2 |

|

8 |

France |

4.9 |

|

9 |

India |

4.2 |

|

Values in US$ billion |

Generation Equipment |

|

|

Rank |

Exporters |

2022 |

|

|

World |

153.3 |

|

1 |

China |

v75.5 |

|

2 |

Germany |

26.9 |

|

3 |

Mexico |

22.1 |

|

4 |

USA |

22.1 |

|

5 |

Hong Kong, China |

17.6 |

|

6 |

Japan |

14.7 |

|

7 |

Italy |

10.1 |

|

8 |

Korea, Republic of |

9.7 |

|

9 |

Poland |

9.5 |

|

10 |

Türkiye |

8.8 |

|

11 |

Viet Nam |

8.8 |

|

12 |

Czech Republic |

8.3 |

|

13 |

Spain |

6.9 |

|

14 |

France |

6.6 |

|

15 |

Netherlands |

6.0 |

|

16 |

Romania |

5.8 |

|

17 |

Singapore |

5.4 |

|

18 |

Taipei, Chinese |

5.4 |

|

19 |

India |

4.7 |

India’s Capital Goods manufacturing industry serves as a strong base for its engagement across sectors such as Engineering, Construction, Infrastructure and Consumer goods, amongst others.

The engineering sector is the largest of the industrial sectors in India. It accounts for 27% of the total factories in the industrial sector and represents 63% of the overall foreign collaborations. Demand for engineering sector services is being driven by capacity expansion in industries like infrastructure, electricity, mining, oil and gas, refinery, steel, automobiles, and consumer durables. India has a competitive advantage in terms of manufacturing costs, market knowledge, technology, and innovation in various engineering sub-sectors. India’s engineering sector has witnessed remarkable growth over the last few years, driven by increased investment in infrastructure and industrial production. The engineering sector, being closely associated with the manufacturing and infrastructure sectors, is of huge strategic importance to India’s economy.

The development of the engineering sector of the economy is also significantly aided by the policies and initiatives of the Indian government. The engineering industry has been de-licensed and allows 100% foreign direct investment (FDI).

Additionally, it has grown to be the biggest contributor to the nation’s overall merchandise export. The Capital Goods sector contributes to 12% of India’s manufacturing output and 1.8% of GDP. Market valuation of the capital goods industry was US$ 43.2 billion in FY22. Imports of Electrical Machinery in India increased to US$ 11.38 billion in FY23.

The Indian electrical equipment industry comprises of two broad segments, Generation equipment (boilers, turbines, generators) and Transmission & Distribution (T&D) and allied equipment like transformers, cables, transmission lines, etc. The sector contributes about 8% to the manufacturing sector in terms of value, and 1.5% to overall GDP. Incentives for capacity addition in power generation will further increase the demand for electrical machinery.

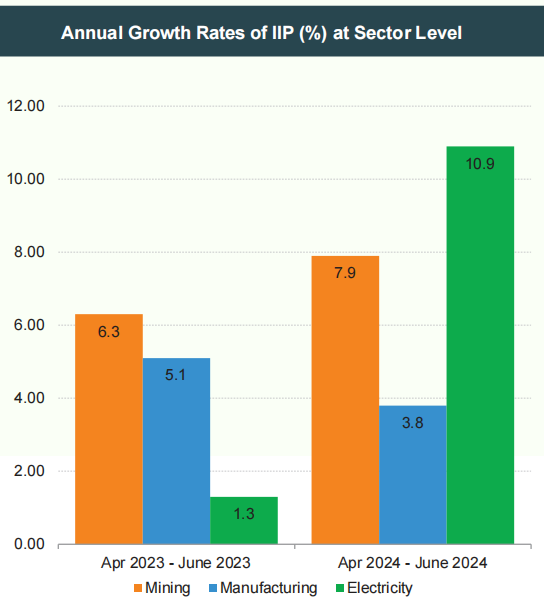

The Index of Industrial Production (IIP), in absolute terms, is projected to be 141.6 in September 2023 as against 133.8 in September 2022. The electrical equipment market share in India is expected to increase by US$ 33.74 billion from 2021 to 2025 at a CAGR of 9%. The domestic electrical equipment market is expected to grow at an annual rate of 12% to reach US$ 72 billion by 2025. In FY21, India’s heavy electrical equipment production stood at Rs. 168,949 crore (US$ 21.15 billion). Production of generation equipment (boilers, turbines and generators) in India is estimated to be around US$ 5.7 billion by 2022. The electrical machinery/equipment segment grew nearly 90% with shipments jumping to Rs. 13,606 crore (US$ 1.6 billion) in April-July 2022 from Rs. 7,202 crore (US$ 869 million) in the year-ago period.

INDIA’S ENGINEERING GOODS EXPORTS COVERING IMPORTANT MACHINERIES

• The Indian textile machinery industry was expected to touch the US$ 6 billion mark by 2022. India’s textile machinery exports registered a growth of 21.4% to US$ 762.15 million in the first nine months of 2022.

• The market size of the Plastic machinery sector stood at US$ 0.5 billion.

• The market size of the process plant equipment sector stood at US$ 3.7 billion.

• In 2021, the production data of Earthmoving and Mining Machinery stood at US$ 3.5 billion.

• Foundry industry has a turnover of approx. US$ 19 billion with export approx. US$ 3.1 billion.

• There are 750–800 domestic Medical Devices manufacturers in India, with an average investment of US$ 2.3–2.7 million and an average turnover of US$ 6.2-6.9 million.

• The Indian industrial fasteners market is expected to reach a value of Rs. 460 billion by 2023 expanding at a CAGR of ~9.6% from 2018.

• India steam boiler systems market size is expected to reach nearly US$ 22.56 billion by 2027 with the CAGR of 4.63% during the forecast period.

• The India generator sets market is expected to grow at a CAGR of more than 5% over the period of 2020-2025.

• The India power transformer market is expected to rise at a CAGR of more than 3% during the forecast period of 2020-25.

• Indian switchgear market is projected to grow at a CAGR of over 15% through 2023, on account of rising development across residential, commercial and industrial enduse sectors.

• India’s automotive industry is worth more than US$ 222 billion, contributes 8% of the country’s total export, accounts for 7.1% of India’s GDP and is set to become the 3rd largest in the world by 2030.

• Indian auto components industry, which accounts for 2.3% of India’s GDP currently, is set to become the 3rd largest globally by 2025. According to the Automotive Component Manufacturers Association of India, the auto-components industry of India is expected to grow by 10-15% in FY24, which would be driven by both domestic and export market demand.

• The Indian agricultural equipment market reached a value of Rs. 1,023.2 billion (US$ 12.3 billion) in 2022. India’s farm equipment market is likely to grow to US$ 18 billion by 2025.

• The Indian machine tools market size reached US$ 1.4 Billion in 2022 and is expected to reach US$ 2.5 billion by 2028, exhibiting a growth rate (CAGR) of 9.4% during 2023-28.

• The Indian automated material handling (AMH) market was valued at US$ 1,353.8 million in 2020 and is expected to go up to US$ 2,739.34 million by 2026 at a CAGR of 12.7%

Some Encouraging Pointers

• In FY21, India’s heavy electrical equipment production stood at Rs. 168,949 crore (US$ 21.15 billion). The electrical equipment market is forecasted to grow at 12% CAGR to reach US$ 72 billion by 2025 from US$ 48-50 billion in 2021. The electrical equipment export market is forecasted to reach US$ 13 billion by 2025, from US$ 8.62 billion in 2021.

• Indian machine tool production and consumption were estimated at Rs. 6,602 crore (US$ 879.38 million) and Rs. 12,036 crore (US$ 1.6 billion), respectively, in FY21, while exports stood at Rs. 531 crore (US$ 66.48 million).

• The boiler industry’s market size stood at US$ 146 million in 2019 and is expected to grow at a CAGR of 6% to reach US$ 194 million by 2025. Export of boilers stood at US$ 106.53 million between April-November 2020, with around 72 million units exported.

• The market size of high voltage switchgear (including panels) and low voltage switchgear (including panels) stood at Rs. 4,793 crore (US$ 679.95 million).

• In FY23, the exports of engineering goods from India have been estimated to stand at US$ 107.04 billion.

• In FY22, India exported engineering goods worth US$ 111.63 billion, a 45.51% increase YoY. India exports engineering goods mostly to the US and Europe, which account for over 60% of the total exports.

The Indian engineering sector is of strategic importance to the economy owing to its intense integration with other industry segments. The sector has been de-licensed and enjoys 100% FDI. With the aim to boost the manufacturing sector, the government has relaxed the excise duties on factory gate tax, capital goods, consumer durables and vehicles.

Tamil Nadu is the fourth-largest state of India. Located on the southern coast of India, Tamil Nadu is surrounded by Andhra Pradesh on the north, Karnataka and Kerala on the west, Indian Ocean on the south, and Bay of Bengal on the east.

Tamil Nadu has a diversified manufacturing sector and features among the leaders in several industries like automobiles and auto components, engineering, pharmaceuticals, garments, textile products, leather products, chemicals, plastics, etc. It ranks first among the states in terms of the number of factories and industrial workers. At current prices, Tamil Nadu’s gross state domestic product (GSDP) is estimated to be Rs. 28.3 trillion (US$ 341.79 billion) in 2023-24 and increase at a CAGR of 11.66% between 2018-19 and 2023-24.

In 2020-21, the tertiary sector contributed 54.33% to the state’s Gross State Value Added (GSVA) at current prices, followed by the secondary sector at 32.72%. According to Department for P ro m o t i o n of Industry and Internal Trade (DPIIT), cum u l a t i v e FDI inflows in the state a m o u n t e d to US$ 10.93 billion between October 2019 and March 2024. In September 2021, the UAE-based DP World announced an investment of Rs. 2,000 crore (US$ 271.68 million) to establish numerous projects in Tamil Nadu. These projects include a container terminal, cold storage and seafood processing zone, free trade zone with an integrated rail siding, minor port in the Eastern Coast of Tamil Nadu and inland container depots in Erode, Karur and Tiruppur

In July 2021, Tamil Nadu exchanged 35 memorandums of understanding (MoUs) with a cumulative investment of Rs. 17,141 crore (US$ 2.33 billion) and employment opportunities for 55,054 people. These investments are in the fields of power plants, electronics, auto components, industrial parks, IT/ ITeS services, food processing, footwear, pharmaceuticals, and textiles

Between the second quarter and third quarter of FY21, the state received new investments of ~Rs. 61,000 crore (US$ 8.3 billion). Of this, some key private investments included Rs. 4,629 crore (US$ 631 million) solar photovoltaic modules project by SunEdison Energy India; Rs. 2,500 crore (US$ 341 million) lithium-ion batteries project in Tiruvallur by Lucas-TVS, and a Rs. 2,300 crore (US$ 314 million) plant being set up by Daimler India Commercial Vehicles at Oragadam.

Total merchandise exports from the state stood at US$ 40.65 billion in FY23, and US$ 43.56 billion in FY24. The state exported key items such as Engineering Goods, Electronic Goods, Ready-made garments of all textiles, Cotton Yarn/Fabs/Madeups, Handloom Products, Leather and Leather Manufactures, Petroleum Products, Organic and Inorganic Chemicals.Tamil Nadu has a well-developed infrastructure with an excellent road and rail network, three major ports, 15 minor ports, and eight airports across the state providing excellent connectivity. As of FY24, the state had a total installed power generation capacity of 39.80 GW.

Thermal power contributed 16147.04 MW to the total installed power generation capacity, followed by renewable power (20032.73 MW), hydropower (2178.20 MW) and nuclear power (1448.00 MW).

Private sector, with a capacity of 26069.60 MW, was the biggest contributor to the total installed power generation capacity in Tamil Nadu, followed by state utilities (7144.98 MW) and central utilities (6591.39 MW).

BRIEF ON IESS PARTNER STATES:

Karnataka is located in the south of India. It is surrounded by the Arabian Sea on the west, Goa on the northwest, Maharashtra on the north, Andhra Pradesh on the east, Tamil Nadu on the southeast, and Kerala on the southwest.

According to an EXIM Bank report, by 2024-25, Karnataka’s merchandise exports can reach US$ 35.3 billion, and software and services exports can reach US$ 150 billion.

Karnataka has a vibrant automobile, agro, aerospace, textile and garment, biotech, and heavy engineering industries. The state has sector-specific Special Economic Zone (SEZs) for key industries such as IT, biotechnology, engineering, food processing and aerospace. Karnataka is the IT hub of India & home to the fourth-largest technology cluster in the world.

Karnataka boasts of diverse flora and fauna and a 320 km natural coastline, which makes it a nature tourist’s paradise. Karnataka offers a wide range of fiscal and policy incentives for businesses under the Karnataka Industrial Policy 2020-25, with simplified procedures for investment. In September 2017, the government of Karnataka passed the ‘Karnataka Electric Vehicle and Energy Storage Policy 2017.’ In June 2021, the Karnataka government amended the policy to offer more impetus to the electric mobility sector. As per the amendment, a 15% subsidy was announced on capital expenditure on land value (fixed value assets up to a maximum limit of 50 acres of land).

As of May 2024, the state had an installed power generation capacity of 33,389.69 MW. Of this, central utilities contributed 4364 MW, private utilities (20179 MW), and state utilities (8,845 MW). Of the total installed power generation capacity, 10,761 MW was contributed by thermal power, followed by nuclear (698.00 MW), renewable power (18,298 MW) and hydropower (3,631 MW)

As per the State Budget 2024-25, Rs. 23,100 crore (US$ 2.77 billion) was allocated for the energy sector. Out of this, Rs. 12,786 crore (US$ 1.53 billion) was allocated to provide subsidies to Karnataka Power Transmission Corporation Limited.

Madhya Pradesh offers distinctive monetary and strategy/policy incentives for organizations under the Industrial Promotion Policy-2014 other than strategies/policies for information technology (IT), biotechnology, tourism, and special economic zone (SEZs). To pull in investors and promote entrepreneurs, the State Government has selected TRIFAC, an agency that encourages a single window system, for speedy approvals of different clearances and consents.Exports from the state stood at US$ 7.88 billion in FY24. In FY24, exports of cotton yarn stood at US$ 982.5 million. According to the Department for Promotion of Industry and Internal Trade (DPIIT), cumulative FDI inflow in Madhya Pradesh was valued at US$ 553.49 million between October 2019-March 2024.

Under the Vision 2030, the processing capacity of horticulture produce will be enhanced from 7.5% to 15% of the total horticulture production by 2030.

Uttarakhand is located in the foothills of the Himalayan mountain range. The state shares borders with China (Tibet) in the north, Nepal in the east, and inter-state boundaries with Himachal Pradesh in the west and northwest and Uttar Pradesh in the south. It has almost all agro-geo climatic zones, which provide commercial opportunities for floriculture and horticulture. The state is home to more than 175 species of rare medicinal, aromatic & herbal plants. The state has proximity to the national capital, Delhi, a leading market of the country and excellent connectivity with neighboring states.Uttarakhand has abundant natural resources due to hills and forests. Its agro-climatic conditions support horticulture-based industries. The vast water resources available in the state are also favorable for hydropower.

Madhya Pradesh is growing as a solar power hub with the Rewa solar power project (new 750 MW solar power plant) and an upcoming 600 MW floating solar energy project at Omkareshwar Dam on the Narmada River. Madhya Pradesh is located in central India. The state is bound on the north by Uttar Pradesh, on the east by Chhattisgarh, on the south by Maharashtra, and on the west by Gujarat and Rajasthan. It is among the fastest growing states in the country. At current prices, the Gross State Domestic Product (GSDP) of Madhya Pradesh was estimated at Rs. 13.87 trillion (US$ 166.31 billion) in 2023-24.

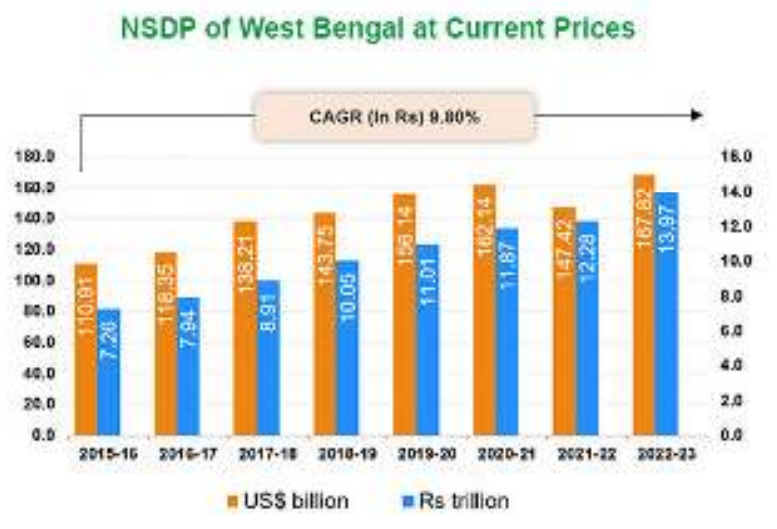

Net State Domestic Product (NSDP) of Madhya Pradesh was estimated to be about Rs. 12.42 trillion (US$ 148.92 billion) in 2023-24. Between 2015-16 and 2023-24, the state’s NSDP increased at a CAGR of about 12.44%. Madhya Pradesh is rich in natural resources - fuel, minerals, agriculture, and biodiversity. It is also the only diamond producing state in the country. Diamond production in the state stood at 38,437 carats in 2018-19.

Uttarakhand is one of the fastest growing states in India, thanks to the massive growth in capital investment arising from conducive industrial policy and generous tax benefits.

The state offers a wide range of benefits in terms of interest incentives, financial assistance, subsidies, and concessions. Uttarakhand has a robust social and industrial infrastructure, virtual connectivity with over 39,000 km of road network, two domestic airports, 345.23 km of rail routes.

As of May 2022 (Upto December), 30 Industrial Entrepreneurs Memorandums (IEMs) worth US$ 209.30 million have been filed in Uttarakhand.

BRIEF ON IESS FOCUS STATES:

Gujarat is the fourth-largest state in milk production in India with a share of 7.56% of the total milk production in the country and consists of 19,522 cooperative milk societies in the state. Gujarat is located on the western coast of India and has the longest coastline of 1,600 kms among all the states in the country. The state shares its borders with Rajasthan, Madhya Pradesh, Maharashtra, and the Union Territories of Daman and Diu and Dadra and Nagar Haveli. The Arabian Sea borders the state on the west and the southwest. Gujarat is one of the leading industrialized states in India. Gujarat is considered the petroleum capital of India due to presence of large refining capacity set up by private and public sector companies. In 2022-23, Gujarat contributed 8.6% to India’s GDP.

The state is the world’s largest producer of processed diamonds, accounting for 72% of the world’s processed diamond share and 80% of India’s diamond exports. With a contribution of 65 to 70% to India’s denim production, Gujarat is the largest manufacturer of denim in the country and the third largest in the world. There are 42 ports, 17 domestic airports and 3 international airports. There are 106 product clusters and 60 notified special economic zones (SEZs). Large scale investment is expected in Gujarat as part of the US$ 90 billion Delhi-Mumbai Industrial Corridor (DMIC).

Ahmedabad is India’s first UNESCO World Heritage City of Gujarat which has been included in the list of the “World’s 50 Greatest Places of 2022” by Time Magazine.

The first IFSC (International Financial Services Centre) in India has been set up at the Gujarat International Finance Tec-City (GIFT City) in Gandhinagar.In 2022-23, the secondary sector contributed 42.90% to the state’s GSDP (at current prices), followed by tertiary (37.3%) and primary (20.09%) sectors.

Haryana is the third-largest exporter of software and one of the preferred destinations for IT/ITeS facilities in India. Haryana is among the northernmost states in India and is adjacent to Delhi, the national capital of India. It is surrounded by Uttar Pradesh in the east, Punjab in the west, Himachal Pradesh in the north, and Rajasthan in the south. The state surrounds the national capital city, New Delhi, from three sides. Historically a rural state, Haryana today is a well-developed industrial state.

The state is one of India’s largest automobile hubs and accounts for two-thirds of passenger cars, 50% of tractors and 60% of motorcycles manufactured in the country.

The state has also emerged as a base for the knowledge industry, including IT and biotechnology. Haryana is the third-largest exporter of software and one of the preferred destinations for IT/ITeS facilities.

As per the advance estimates for 2024-25, the state’s GSDP at current prices has been estimated at Rs. 12,16,044 crore (US$ 145.11 billion). The state’s GSDP (in Rs.) expanded at a CAGR of 9.39% between 2015-16 and 2024-25

The State Government of Haryana has been committed to creating a progressive business environment. The state offers a wide range of fiscal and policy incentives for businesses under the Industrial and Investment Policy, of 2011. Haryana ranked the third best state in the country under ease of doing business in the Business Reforms Action Plan 2017. As of October 2020, the state had seven exporting Special Economic Zones (SEZs).

Recent Developments:

• Merchandise exports from Haryana reached US$ 12.06 billion in FY20, US$ 11.60 billion in FY21 and US$ 15.55 billion in FY22. It eventually reached at US$ 17.66 billion in FY24.

• According to the Department for Promotion of Industry and Internal Trade (DPIIT), cumulative Foreign Direct Investment (FDI) inflows in Haryana stood at US$ 1.91 billion in FY24 and was US$ 9.73 billion between October 2019-March 2024.

The state is home to a large number of MSME units. The state is amongst the top ten states accounting for the highest number of MSME enterprises. Odisha is located in the eastern region of India. The state shares its borders with West Bengal on the north-east, Jharkhand on the north, Andhra Pradesh on the south, Chhattisgarh on the west, and the Bay of Bengal on the east

At current prices, the state’s gross state domestic product (GSDP) was estimated to be Rs. 8.65 trillion (US$ 103.84 billion) in 2023-24. Odisha’s GSDP is expected to increase at a CAGR of 11.92% between 2016-17 and 2023-24.

According to the DPIIT, cumulative FDI inflows in the state stood at US$ 168.55 million between October 2019- March 2024.

Odisha has emerged as the key state with regard to the mineral and metal-based industries. In 2019-20^, Odisha contributed to the largest share (43.0%) of mineral production (by value) in India. The value of minerals produced in the state reached Rs. 87,086 crore (US$ 10.78 billion) in 2021-22.

Odisha has a well-developed social, physical, and industrial infrastructure, and the state government has undertaken several infrastructural projects to further promote overall development. The state’s infrastructure includes well-connected road and rail networks, airports, ports, power, and telecom.Total merchandise exports from Odisha stood at US$ 11.93 billion in FY24. Iron ore, iron & steel and aluminium & aluminium products accounted for a majority share in the overall exports from the state.

BRIEF ON IESS PARTNER & FOCUS STATES:

Key Sectors:

• Under the State Budget 2023-24, Rs. 27,593 crore (US$ 3.31 billion) was allotted to the Education, Sports, Arts, and Culture. Out of which Odisha Adarsh Vidyalaya programme and Mo School Abhiyan has been allocated Rs. 842 crore (US$ 101.08 million) and Rs 805 crore (US$ 96.64 million), respectively.

• As of March 2024, Odisha had a total installed power generation capacity of 8,124.91 MW, of which 1,964.21 MW was under the central utilities, 3,840.52 MW (under state utilities) and 2,320.18 MW (under private sector). Of the total installed power generation capacity, 5,291.21 MW was contributed by thermal, 2,163.22 MW by hydro, and 670.48 MW by renewable energy.

• Under the State Budget 2023-24, Rs. 4,906 crore (US$ 588.9 million) was allotted to the Urban development out of which Rs. 996 crore (US$ 119.57 million) has been allocated towards the AMRUT scheme and Rs. 300 crore (US$ 36.01 million) has been allocated towards new city development.

• In State Budget 2023-24, Odisha allocated 7.6% of its total expenditure on health, (higher than the average allocation for health by other states 6.3%), 7.1% on rural development (higher than the average allocation for rural development by other states 5.7%) and 7.7% on roads and bridges (higher than the average allocation by states 4.5%).

• As of July 2022, the state had five operational, five notified and seven formally approved SEZs.

• In 2021-22*, the total production of horticulture crops in the state was expected to be 13,062.98 thousand tonnes and the area under production was 1,463.76 thousand hectares. In 2021-22*, the total production of vegetables and fruits was estimated at 9,523.71 thousand tonnes and 2,782.05 thousand tonnes, respectively.

• In 2021-22, 3,898,770 domestic tourists and 3,153 foreign tourists visited Odisha.

• Odisha’s industries are based mainly on the natural resources available in the state. It carries more than 35% of the country’s natural resources. The state has significant reserves of iron ore, bauxite, nickel, coal, etc. Hence, it is an attractive destination for mineral-based industries. In March 2021, ArcelorMittal-Nippon Steel India and the Odisha government signed a MoU to establish a 12 MT integrated steel plant in the state, with an investment worth Rs. 50,000 crore (US$ 6.88 billion).

• In Union Budget 2021, Odisha allocated 6.4% of its total expenditure on health, higher than the average allocation for health by other states (5.5%), 7.5% on rural development higher than the average allocation for rural development by other states (6.1%) and 7.8% on roads and bridges higher than the average allocation by states (4.3%).

• In the Maritime India Summit 2021, the government announced to establish Odisha as the hub of maritime trade.

Uttar Pradesh has the biggest railway network in the country with a railway density of 40 km which is double the rail density of the India.

Uttar Pradesh is the most populous state in India with a population of more than 200 million people. Uttar Pradesh shares its borders with Nepal on the north, the Indian states of Uttarakhand and Himachal Pradesh on the northwest, Haryana, Delhi and Rajasthan on the west, Madhya Pradesh on the south, Chhattisgarh and Jharkhand on the southeast, and Bihar on the east.In August 2022, Uttar Pradesh revealed the draft of its Solar Energy Policy-2022, which indicates that the state has a goal of producing 16,000 MW of renewable energy by 2026–27.

Uttar Pradesh is the largest producer of food grains in India and accounted for about 17.83% share in the country’s total food grain output in 2016-17. Food grain production in the state stood at 49,903.1 thousand tonnes in 2016-17 and 51,252.7 thousand tonnes in 2017-18. Major food grains produced in the state include rice, wheat, maize, millet (bajra), gram, pea and lentils.

Pulses production in the state stood at 2.56 million tonnes in 2020-21*. Production of vegetables stood 29,940.09 thousand MT in 2021-22*.

The state offers a wide range of subsidies, policy and fiscal incentives as well as assistance for businesses under the Industrial and Service Sector Investment Policy, 2004 and Infrastructure and Industrial Investment Policy, 2012. The state has well-drafted, sector-specific policies for IT and biotechnology. The new Uttar Pradesh Civil Aviation Promotion Policy 2017 was brought to promote investment and trade in Uttar Pradesh and to promote tourism while increased road connectivity along with air connectivity will create more employment avenues.

In 2019, 147 investment intentions worth Rs. 16,799 crore (US$ 2.40 billion) were filed in Uttar Pradesh.

In 2020, the state government rolled out the New Electronics Manufacturing Policy, 2020 and Uttar Pradesh Startup Policy, 2020, to promote the local manufacturing and new startups in the state.

Uttar Pradesh Tourism:Uttar Pradesh is a favored tourist destination in India with Taj Mahal, one of the eight wonders of the world, located in Agra. The state witnessed rise in tourist arrivals, with 320 million tourists arriving in 2023, and is expected to grow further. The opening of the Ram temple in Jan 2024 significantly increases religious tourism in Uttar Pradesh. According to Jefferies, the Ram temple is projected to attract at least 100 million visitors annually. Additionally, Uttar Pradesh government is also established the UP-Ecotourism Development board. The key objective of the initiative is to promote the state’s rich legacy of forests and wetlands to increase tourist footfall while creating jobs for those living around the natural heritage.

Economy of Uttar Pradesh:At current prices, the gross state domestic product (GSDP) of Uttar Pradesh is estimated to be Rs. 24.99 trillion (US$ 300.01 billion) in 2024-25. The GSDP is expected to increase at a CAGR of 9.05% from 2018-19 to 2024-25. As of March 2024, Uttar Pradesh had an installed power generation capacity of 31,426.33 MW. of 31,426.33 MW. Of this, 7,908.20 MW was from state utilities, 14,773.20 MW (private utilities) and 8,744.93 MW (central utilities). Thermal power contributed 22,517.26 MW to the state’s total installed power generation capacity, followed by 3,424.02 MW (hydropower), 289.48 MW (nuclear power) and 8,619.59 MW (renewable power), as of March 2024. According to Department for Promotion of Industry and Internal Trade (DPIIT), cumulative FDI inflow in Uttar Pradesh stood at US$ 1,634.97 million between April 2000-March 2024. Merchandise exports from Uttar Pradesh reached US$ 20.57 billion in FY24 v/s US$ 21.68 billion in FY23. Electronic goods were the leading export category with 22% share of state exports in 2023-24.

Industries in Uttar Pradesh:Uttar Pradesh is the largest producer of food grains in India and accounted for about 17.83% share in the country’s total food grain output in 2016-17. Prime Minister, Mr. Narendra Modi laid the foundation stone and dedicated to the nation multiple development projects worth over Rs. 19,150 crores (US$ 2.30 billion) in Varanasi, Uttar Pradesh. According to the state government, as many as 1,500 projects worth more than Rs. 70,000 crore (US$ 9.03 billion) are planned to be launched in UttarPradesh’s third groundbreaking ceremony to be held in June 2022. Some of these major projects are:

• Adani Group’s project worth around Rs. 4,900 crore (US$ 631.86 million).

• Hiranandani Group’s two data centres in Noida with an investment of Rs. 9,100 crore (US$ 1.17 billion).

• Microsoft’s Rs. 2,100 crore (US$ 270.85 million) software development centre.

• Dalmia Group’s Rs. 600 crore (US$ 77.38 million) cement manufacturing plant in Mirzapur, Hamirpur.

h4 class="mt-3">Recent Developments in Key Sectors:• In October 2022, Minister of Road Transport and Highways, Mr. Nitin Gadkari, announced new projects worth Rs. 7,000 crore (US$ 8.5 billion) for Uttar Pradesh.

• In October 2022, Chief Minister Mr. Yogi Adityanath said that from the following academic year, all colleges and institutions in Uttar Pradesh will offer medical and engineering programmes in Hindi.

• In the State Budget 2024-25:» In the State Budget 2024-25, Rs. 40,686 crore (US$ 4.8 billion) has been allocated for the development of roads and bridges. Of this, Rs. 668 crore (US$ 80.19 million) is allocated for road transportation.

» As per the State Budget 2024-25, Rs. 45,832 crore (US$ 5.5 billion) has been allocated to the energy sector. Out of this, Rs. 16,400 crore (US$ 1.97 billion) is allocated for power subsidies. Rs. 1,800 crore (US$ 216 million) grants have been allocated to UPPCL for tariff subsidy to private tubewell consumers.

» As per State Budget 2024- 25, a total amount of Rs. 23,744 crore (US$ 2.85 billion) has been allocated towards Urban Development. Out of this, Rs. 2,674 crore (US$ 321.01 million) has been allocated for grants towards the creation of capital assets under PM Awas Yojana (Urban).

» In the State Budget 2024- 25, the state Government allocated Rs. 1,00,335 crore (US$ 12.05 billion) towards Education, Sports, Arts, and Culture. Out of this, Rs. 1,856 crore (US$ 222 million) is allocated towards primary education under Samagra Shiksha Abhiyan.

» As per State Budget 2024-25, Rs. 42,774 crore (US$ 5.13 billion) was allocated to the health and family welfare sector

• 41,336 food processing units will be established/upgraded in 2022 under the Pradhan Mantri Formalisation of Micro Food Processing Enterprises Scheme.

• With the help of the state government’s Food Processing Industries Policy 2017 (revised), the government has planned to set up 375 large food processing units in 2022.

• In May 2022, Amity University in Noida, Uttar Pradesh, signed an MoU with the Tourism & Hospitality Skill Council (THSC), with the aim to train the students in the field of tourism, travel, hospitality and aviation by different campuses of Amity University, through the implementation programmes under this MoU.

• Uttar Pradesh has now become home to the country’s first-ever ‘Amrit Sarovar’ which was inaugurated in Rampur district in May 2022. It is one of the 789 ponds which the Uttar Pradesh government will develop. Nearly Rs. 60 lakh (US$ 77,384.88) were spent in the creation of this water body

• In June 2021, Uttar Pradesh receives a record investment of Rs. 4,074 crores (US$ 554.24 million) in food processing.

• The tourism administration of Uttar Pradesh is planning to develop a helicopter taxi service to connect the state’s most popular locations, as of September 2021.

• Uttar Pradesh has capacity to produce 4,248.76 MW of renewable energy. The state Government has set an objective of annual addition for production capacity of solar energy to 2,000 MW.

• In June 2021, Greenply Industries announced that it will invest around Rs. 75 crore (US$ 10.30 million) to set up a plywood and allied products manufacturing unit at Sandila Industrial Area in Hardoi, Uttar Pradesh.

• In May 2021, Uttar Pradesh government announced that it would spend US$ 1 billion to buy COVID-19 vaccine.

• In January 2021, the state government announced its plan to build 1,038 new Ganga aarti platforms along the river in Bijnor and Ballia districts.

• Uttar Pradesh accounts for strong demand for fertilisers on account of the high availability of acreage coupled with the large size of the state.

West Bengal is situated in eastern India and shares its borders with Jharkhand, Bihar, Odisha, Sikkim, and Assam. The state also shares international borders with Bangladesh, Bhutan, and Nepal. The Bay of Bengal is in the south of West Bengal.

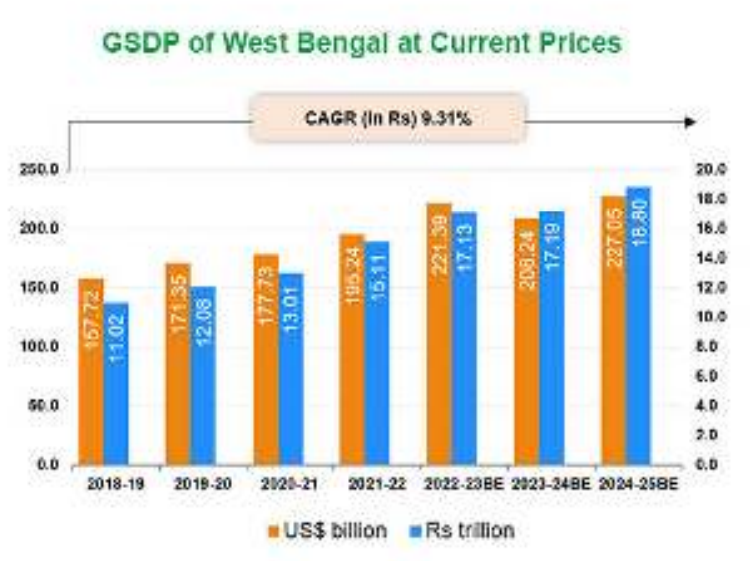

West Bengal, India’s sixth largest state in terms of economic size, has a projected Gross State Domestic Product (GSDP) of Rs. 18.8 trillion (US$ 227.05 billion) in 2024-25. The average annual GSDP is estimated to increase at 10.5% from 2023-24BE.

In FY24 the total exports from the state stood at US$ 11,684.64 million. West Bengal exported key items such as Engineering Goods and Gems and Jewellery

During 2018-19, the state produced a total of 1.85 million tonnes of fish

West Bengal is the second largest tea-producing state in India and is home to the globally acclaimed Darjeeling tea variety. West Bengal is the largest producer of rice in India. Rice production for the state totalled 13.32 million tonnes in 2021-22.

Its location advantage makes the state a traditional market for eastern India, the Northeast, Nepal, and Bhutan. It is also a strategic entry point for markets in Southeast Asia. The cost of operating a business is lower in Kolkata than in other metropolitan cities.

West Bengal has abundant natural resources of minerals and suitable agro-climatic conditions for agriculture, horticulture, and fisheries. It is in vicinity to mineral rich states like Jharkhand, Bihar, and Odisha.

It offers excellent connectivity to the rest of India in terms of railways, roadways, ports, and airports.

As of March 2024, West Bengal had a total installed power generation capacity of 10,800.27 MW, of which 5,997.95 MW was under state utilities, 2,955.98 MW under private sector and 1,846.34 MW under central utilities

Of the total installed power capacity, 8763.34 MW was contributed by thermal power, 1396.00 MW by hydropower and 640.93 MW by renewable power

Between October 2019-March 2024, FDI inflows in West Bengal stood at US$ 1,609.67 million.

West Bengal ranked eleventh among Indian states on ease of doing business and reforms implementation according to a study by the World Bank and KPMG.

Key Sectors• In June 2022, various Indian Railways projects to the tune of Rs. 254 crore (US$ 30.83 million) were launched in West Bengal’s Hooghly district.

• HDC Bulk Terminal Ltd (HBTL), a wholly owned subsidiary of Adani Ports and Special Economic Zone Limited (APSEZ), has signed the Concession Agreement with Syama Prasad Mookerjee Port, Kolkata (SMPK) for mechanization of Berth no. 2 at Haldia Port.

• In August 2022, a Special Food Processing Fund of Rs. 2,000 crore (US$ 242.72 million) was set up with National Bank for Agriculture and Rural Development (NABARD) to provide affordable credit for investments in setting up Mega Food Parks (MFP) as well as processing units in the MFPs.

•Tea production in West Bengal stood at 418.84 million kg in FY23.

•In 2021, domestic tourist arrivals in the state were 243.25 million and foreign tourist arrivals had crossed over 0.34 million.

•In FY22, total exports of iron and steel from West Bengal stood at US$ 1,851.38 million, which was 13.32% of the total exports.

• In FY23 total exports of iron and steel from West Bengal stood at US$ 1,579.03 million, which was 12.39% of the total exports.

• The State Budget 2022-23 seeks to provide relief to the tea industry by exempting rural employment cess and waiving agricultural income tax in FY 2022-23.

• GAIL, its JV company Bengal Gas Co and Hindustan Petroleum Corporation Ltd’s will invest Rs. 17000 crore (US$ 2.2 billion) in various CNG projects in West Bengal over the next five years.

• ONGC will invest Rs. 1,500 crore (US$ 193.85 million) over the next 3-4 years for gas exploration at Ashoknager in North 24 Parganas district of West Bengal.

• West Bengal has allocated 16.8% of its total expenditure for education in 2022-23. This is higher than the average allocation (15.2%) for education by all states as per 2021-22 Budget Estimates.

• In State Budget 2024-25 Rs. 22,620 crore (US$ 2.73 billion) has been allocated to Agriculture and Allied Activities of which Rs 5,800 crore (US$ 700.48 million) has been allocated for financial support to Krishak Bandhu and Rs 1,200 crore (US$ 144.93 million) has been allocated for crop insurance

• As per State Budget 2024-25 Rs. 47,470 crore (US$ 5.73 billion) has been allocated for Education, Sports, Arts, and Culture of which Rs 18,029 crore (US$ 2.18 billion) has been allocated for assistance to non-government primary schools and Rs 7,732 crore (US$ 0.93 billion) has been allocated for assistance to non-government secondary schools.

• In 2018-19, West Bengal remained the second largest producer of potato in India, accounting for about 24.31% of the country’s potato output. The state’s potato production stood at 13.78 million tonnes in 2018-19.

• As of October 2020, West Bengal had 21 SEZs; of this, seven were operational, five were notified, seven were formally approved and two had in-principle approval.

• As per State Budget 2021-22, the government has allocated Rs. 183.51 crore (US$ 25.35 million) for development of the IT and Electronics Department in West Bengal.

• Moreover, the state is also a key producer of petroleum and petrochemicals. Production of natural gas in the state reached 534 million cubic metres in 2020-21*

• Total export from IT sector from the state was estimated at Rs 22,897 crore (US$ 3.28 billion) in 2018-19. The State Government introduced West Bengal Information

Technology and Electronics Policy 2018 which envisages West Bengal as one of the leading states in India in the IT, ITeS, ICT and ESDM sectors. In August 2021, the State IT Minister Mr. Partha Chatterjee, as part of the state’s plan to position West Bengal as an IT hub, earmarked another 100 acres of land for its Silicon Valley Tech Hub.