Spotlight

Sustainable engineering plays a pivotal role in shaping a future where environmental preservation and economic prosperity go hand in hand. By integrating principles of efficiency, environmental responsibility, and social awareness, innovators are propelling us towards a more sustainable world. Amidst global efforts to combat climate change, the European Union (EU) has taken bold steps with initiatives like the Carbon Border Adjustment Mechanism (CBAM), aimed at aligning trade practices with environmental imperatives.

Principles of Sustainable Engineering

Efficient resource utilization, minimal environmental impact, social responsibility, lifecycle perspective, and collaboration constitute the bedrock of sustainable engineering. Guided by these principles, efforts are directed towards designing sysems and processes that not only meet current needs but also safeguard the interests of future generations.

Role of CBAM in Transition to Sustainability

To further ensure sustainable practices, the European Union (EU) has introduced CBAM, which aims to reduce carbon emissions. In a world increasingly conscious of the urgent need to combat climate change and sustainability, EU has set its sights on an ambitious target: reducing net greenhouse gas emissions by at least 55% by the year 2030, compared to 1990 levels.

Achieving this ambitious goal hinges on the reform and expansion of the EU Emissions Trading System (ETS), a cornerstone of the EU’s climate policy. Under the ETS, a limited supply of emission permits is either auctioned or allocated to polluting industries, with these permits subsequently traded on a dedicated market. This mechanism not only puts a price on emissions but also provides a powerful incentive for industries to adopt low-carbon technologies. However, this shift towards cleaner practices can potentially lead to higher costs for sectors operating under the ETS, causing them to move their carbon-intensive operations to regions with less stringent environmental regulations—a phenomenon known as “carbon leakage.”

To address this challenge, the EU currently employs a strategy involving the allocation of free allowances—essentially, granting a limited number of emissions permits to sectors deemed highly vulnerable to carbon leakage. This approach is designed to prevent distortions in competitiveness for EU producers in both omestic and international markets. However, free allowances have come under criticism for potentially undermining the EU’s emission reduction efforts and running counter to the EU’s ultimate target of achieving net-zero emissions by 2050.

As part of its ‘Fit for 55’ policy package, the EU is now embarking on a transition away from free allowances in favour of CBAM. CBAM will essentially extend the carbon pricing model used within the EU ETS to emissions associated with production of imported goods destined for the EU market. This will be done unless the exporting country already enforces a comparable carbon pricing mechanism. Discussions surrounding export rebates are also ongoing, to refund allowance osts for EU-produced goods exported to international markets. This approach seeks to ensure that EU industries remain competitive on the global stage while adhering to stringent climate policies.

After months of negotiations,the European Parliament and EU Council have reached a historic agreement on CBAM, set to take effect on October 1, 2023. CBAM represents a significant stride towards equalizing the carbon costs facedby EU products operating under the ETS and their imported counterparts, reinforcing the EU’s commitment to leading the charge in the fight against climate change on the international stage.

The Paris Agreement, hailed as a landmark international treaty on climate change, was adopted in 2015. This global accord, endorsed by a remarkable 195 signatories as of June 2023, set the stage for nations to collectively address the urgent challenge of limiting greenhouse gas (GHG) emissions. Yet, within the framework of the Paris Agreement, countries retained the flexibility to define their own climate ambitions, albeit within certain boundaries. Consequently,some regions and jurisdictions committed to more aggressive carbon reduction targets than others.

Europe, long regarded as a pioneer in climate protection and a driving force behind global environmental initiatives, has consistently aspired to set the gold standard in combating climate change. With an unwavering commitment to becoming the world’s first climate-neutral continent by 2050, Europe unveiled the ambitious European Green Deal in 2019, formally adopted in 2020. This comprehensive strategy comprises an array of tax and non-tax policy measures meticulously designed to chart a course toward the 2050 climate neutrality objective.

In September 2020, the European Union (EU) took a momentous step by announcing its intention to reduce emissions by a formidable 55% by 2030, compared to 1990 levels. To translate this ambitious target into reality, the European Commission introduced a series of legislative proposals in July 2021, bundled under the banner of the “Fit for 55 packages.” These proposals were specifically crafted to facilitate the acceleration of GHG emissions reduction across various sectors, including climate, transport, land use, energy, and taxation.

One pivotal component of the EU’s strategy to align its climate goals with concrete actions is the Carbon Border Adjustment Mechanism (CBAM). CBAM represents a proactive response to the challenges posed by climate change, serving as a bridge between the EU’s commitment under the Paris Agreement and the practical measures required to reduce emissions. By imposing carbon pricing on imported goods and establishing a level playing field for carbon costs, CBAM exemplifies the EU’s resolve to lead by example in the global fight against climate change.What are Embedded Emissions?

The concept has been developed to reflect as much as possible the way in which emissions are covered by the EU ETS as if the CBAM goods were produced in the EU. The EU ETS requires operators to pay a price for their own (“direct”) emissions. However, if they consume electricity, they also experience the CO2 costs included in the price of electricity they purchase (“indirect emissions”). The same applies to the input materials needed for their production process, and which may be supplied by an EU ETS installation. These so-called precursors therefore contribute to the CO2 costs the EU ETS installation faces.The “embedded missions” are defined in parallel to the emissions causing CO2 costs in the EU ETS: they consider the direct and indirect emissions of the production process as well as the embedded emissions of precursors. The scope of the CBAM is principally related to the rules of the EU ETS and therefore has differences to other methods for calculating product carbon footprints such as the “GHG Protocol” or ISO 140671.

CBAM Phases

The CBAM will be Rolled Out in Four Phases:

Phase 1

CBAM’s 27 months transition period has started from 01 October 2023. During the same, exporters would not need to pay any tax but share details of carbon content of steel and aluminium with EU importers.

Phase 2

From January 2026, exporters will start paying CBT on aluminium, steel and other covered products.

Phase 3

From 2026-2034, new products will be gradually brought under the CBT ambit.

Phase 4

From 2034 onwards, all the goods and materials imported into the EU will be taxed under the CBAM.

Affected Products

T here are some new rules that will first apply to goods imported into the European Union (EU) from countries outside the EU. These rules are for products that create a lot of pollution, like certain things in the cement, electricity, fertilizers, aluminium, iron, steel, and hydrogen industries. It also includes some things that are used to make these products, like certain parts for iron, steel, and aluminium. These rules don’t apply to products coming from countries that are part of the EU Emissions Trading System, like Iceland, Norway, Liechtenstein, Switzerland, and a few other small places.

But in the future, by the year 2030, the EU plans to make these rules apply to all industries that are part of the EU emissions trading system.

CEMENT

IRON & STEEL

ALUMINIUM

FERTILIZERS

ELECTRICITY

HYDROGEN

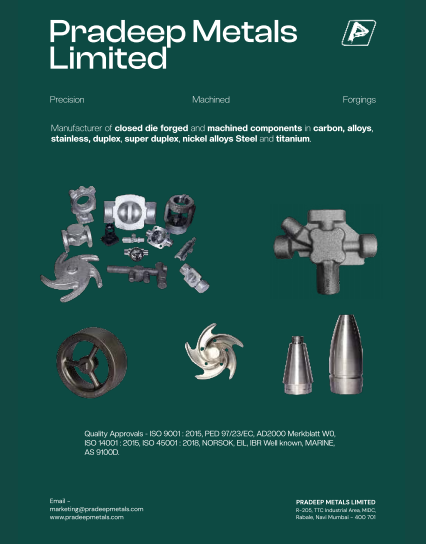

This is the current list of engineering goods covered by CBAM according to the classification of these goods in the Combined Nomenclature :

| Iron and Steel | Aluminium |

|---|---|

| 72 (except 7202 and 7204), 7301, 7302, 7303 00, 7304, 7305, 7306, 7307, 7308 (excluding prefabricated buildings of heading 9406) | 76 (except 7601, 7603, 7604, 7605, 7606, 7607, 7608, 7609a) |

IMPACT ON STEEL

Indian steel production emits approximately 2.6 tonnes of CO2 per tonne of steel, higher than the global average of 1.85 tonnes. India’s steel ector is said to account for about 12% of the country’s total carbon dioxide (CO2) emissions . The CO2 emissions intensity of Indian steel production is higher than the global average, primarily due to the reliance on Blast Furnace-Basic Oxygen Furnace (BF-BOF) routes and coalbased direct reduced iron (DRI) production. Approximately 45-50% of India’s crude steel is produced through the BF-BOF route. This method involves converting iron ore into molten iron in a blast furnace, which is then refined into steel in a basic oxygen furnace.

Electric Arc Furnace (EAF) and Induction Furnace (IF) routes are used to produce steel from scrap. These methods are generally less carbon-intensive compared to the BF-BOF route because they primarily use scrap metal as raw material, which requires less energy to melt and refine. Approximately 55-60% of India’s crude steel is produced using the EAF and IF routes. The EAF route has the potential for lower emissions if powered by renewable energy sources.

The Indian government has been promoting the use of scrap through various initiatives, such as the National Steel Policy, which aims to increase the availability and use of scrap in steel production.

This higher emission rate means Indian steel exporters will face significant CBAM taxes, increasing their production costs. With higher costs, Indian steel products may become less competitive in the European market, potentially leading to a decrease in demand.

Indian steel producers, government bodies, and other stakeholders may need to collaborate to mitigate the impacts of CBAM. Transitioning to more sustainable practices and technologies will be essential for the Indian steel industry to reduce its carbon footprint and align with global climate goals.

IMPACT ON ALUMINIUM

The aluminium production process is energy-intensive, particularly the electrolytic reduction of alumina to aluminium in smelters, which consumes large amounts of electricity. In India, a significant portion of the electricity used in aluminium production comes from coal-fired power plants, which results in high carbon emissions. Upgrading smelting technologies to more energy-efficient and less carbon-intensive options is a critical strategy being pursued by the industry

The industry may need to accelerate its decarbonization efforts, adopting cleaner technologies and practices to reduce emissions and comply with CBAM requirements. The Indian government has introduced various policies and initiatives to encourage the reduction of carbon emissions, including the Perform, Achieve, and Trade (PAT) scheme, which targets improvements in energy efficiency across several industries, including aluminium.

Transitional phase-new reporting rulesOn 17 August 2023, the Commission published the implementing regulation regarding the CBAM reporting regulations during the transitional phase.

REPORTING OBLIGATIONS

The first reporting period for CBAM is Q4 2023, starting on 1 October 2023. The report for the first reporting period must be submitted no later than 31 January 2024. The last CBAM report of the transitional period, which is the report to be submitted for Q4 2025, should be submitted by 31 January 2026.

Within those reports, importers must, inter alia, report the following:

- The type of goods as identified by their CN code.

- The quantity of imported goods, the direct and indirect emissions embedded in them (calculated pursuant to specific methods, see below).

- Any ‘carbon price’ already paid abroad for the emissions, including the carbon price paid for any precursor material embedded in the final product.

- The country where a carbon price is due.

- The country of origin of imported goods.

- The identity and location of the installations where the goods were produced.

- The production routes used for the manufacturing of the goods (and associated production parameters) as defined in the implementing regulation.

The report must be submitted to the CBAM Transitional Registry, which will be managed by the Commission. The CBAM Transitional Registry will be a standardised and secure electronic database containing a trader portal through which importers can submit the quarterly CBAM reports. Both the local competent authorities and the Commission will have access.

to this portal and its data. According to official discussions between the Commission and Member States, this platform will be an additional module of the Economic Operator Registration and Identification (EORI) system (i.e., one of the EU’s customs systems). Once a report is submitted, it can only be amended or corrected until two months after the end of the relevant reporting quarter. In derogation from this general rule, the CBAM reports for the first two reporting periods may be amended or corrected until the submission deadline for the third CBAM report (i.e., Q2 2024), which is 31 July 2024. The penalty for non-compliance, incorrect, or incomplete filing of a CBAM report shall be set by the individual Member State but must be between EUR 10 and EUR 50 per ton of unreported embedded emissions.

HOW WILL CBAM WORK?

Once fully in place as of 2026, the CBAM will work as follows :

Navigating Uncertainties with Government Support

As the Carbon Border Adjustment Mechanism (CBAM) takes centre stage on the global trade platform, the Indian engineering sector, notably the iron and steel and aluminium industries, faces critical challenges and opportunities. Being among the key export destinations, the European Union (EU) introduces a pivotal dimension to the industry’s international trade landscape, one that necessitates strategic considerations and collaborative efforts between industry stakeholders and the Indian government. Some of the recommendations and measures proposed by EEPC India to safeguard the interests of the Indian engineering sector in the context of CBAM are furnished below

Financial Support for Energy Audits

Conducting energy audits is essential for understanding and reducing carbon emissions. However, these audits come at a significant cost, totaling approximately 15 Lakhs. This includes consultancy fees of around 10 Lakhs and certification body costs of around 5 Lakhs. EEPC India had proposed that a substantial portion of this cost, specifically 50%, be reimbursed to Micro, Small, and Medium-sized Enterprises (MSMEs) under the Market Access Initiative (MAI) Scheme. This financial support can make the transition to cleaner production practices more accessible for smaller businesses.

Carbon Emissions Disclosure in Steel Production

It is crucial to recognize that a substantial portion of carbon emissions occurs during the raw material stage of production, particularly in the steel industry. It was proposed that the government mandate all steel manufacturers, whether in the primary or secondary sector, to include carbon emission data in their product test certificates. This transparency will provide a more accurate representation of the environmental impact of products.

Monitoring Mechanism and MSME Deferment

It is understood that, as of October 1, 2023, European importers above a certain threshold are required to participate in the CBAM monitoring mechanism, with smaller importers scheduled to join later. We need to verify the accuracy of this information and explore the possibility of seeking a deferment of three years for our MSME exporters along similar lines. This deferment can provide MSMEs with additional time to prepare for and adapt to the new regulations without undue burden.

Aligning Existing Taxes with CBAM

Acknowledging the absence of a specific carbon tax in India, it is imperative that the country adapts to the changing trade dynamics catalysed by CBAM. To align with CBAM principles and level the playing field, EEPC India proposes that India officially designates existing import and excise duties on petroleum products, natural gas, and GST on coal, steel, and aluminium, among others, as carbon taxes for steel and aluminium products. This strategic move will bolster Indian exporters’ competitiveness and compliance with international carbon pricing measures.

FTAs with Consideration of Carbon Border Tax (CBT)

The engineering sector, particularly in India, enjoys duty-free access to key markets like Korea and Japan under Free Trade Agreements (FTAs). However, the introduction of high CBT rates in countries like the EU threatens to undermine the benefits of existing FTAs, potentially forcing Indian exporters to navigate dual taxation and eroding the duty-free privileges. To safeguard the industry’s interests, EEPC India recommends that India incorporates CBT considerations as a top agenda item in ongoing FTA negotiations, notably with the United Kingdom and the European Union. By doing so, India can ensure that the advantages of FTAs are preserved in the face of evolving climate-conscious trade policies

In conclusion, the European Union’s recent regulations on carbon emissions present a new challenge for Indian companies exporting engineering goods to the EU. This adds to the already difficult situation faced by the exporting community, given the ongoing pandemic, geopolitical tensions, and economic slowdowns. With the EU being a major market for India’s engineering products, particularly steel and aluminium, the introduction of these regulations may increase costs and intensify competition for Indian exporters. To mitigate these impacts, the Government of India has adopted a multi-faceted approach that encompasses policy and regulatory measures, industry-specific initiatives, international engagement, and capacity building. Key strategies include the National Action Plan on Climate Change (NAPCC) and the Perform, Achieve and Trade (PAT) scheme, both aimed at enhancing energy efficiency and promoting renewable energy adoption

India has set ambitious targets for renewable energy capacity, aiming to achieve 175 GW by 2022 and 450 GW by 2030. The promotion of solar, wind, and other renewable energy sources is intended to reduce dependence on fossil fuels and lower carbon emissions across various sectors, including aluminium and steel. The promotion of green hydrogen and increased use of scrap in production processes further illustrate India’s commitment to reducing industrial carbon footprints. Additionally, India is actively participating in international trade negotiations to ensure fair treatment of its exports under CBAM and is exploring carbon pricing mechanisms to incentivize low-carbon technologies.

While India does not have a nationwide carbon pricing mechanism, there are discussions and pilot projects to explore the feasibility of carbon pricing. Implementing carbon pricing can help industries internalize the cost of carbon emissions and drive investments in low-carbon technologies. With major research and development investments and advanced technologies, the industry is now preparing to meet the global sustainability standards. By aligning with global climate goals and fostering innovation, the Indian steel and aluminium industries can transform these challenges into opportunities, paving the way for a greener, more resilient future.