Focus

| Trade Flow | Export figures (in US$ billion) | Growth (%) | ||||

|---|---|---|---|---|---|---|

| Mar-2024 | Mar-2025 | Apr-Mar 2023-24 | Apr-Mar 2024-25 | Mar-2025 over Mar-2024 | Apr-Mar 2024-25 over Apr-Mar 2023-24 | |

| Engineering exports | 11.27 | 10.82 | 109.30 | 116.67 | -3.92% | 6.74% |

| Overall merchandise exports | 41.69 | 41.97 | 437.07 | 437.42 | 0.66% | 0.08% |

| Share of engineering (%) | 27.02% | 25.79% | 25.01% | 26.67% | --- | --- |

| Service Exports | 30.01 | 31.64 | 341.06 | 383.51 | 5.43% | 12.45% |

Source: Compiled from data by DGCI&S and Quick Estimates published by the Government of India.

ENGINEERING EXPORTS DURING 2024-25 – KEY TAKEAWAYS

- Engineering exports from India once again reached its all-time high at USD 116.67 billion in fiscal 2024-25 surpassing the previous high of USD 112.10 billion achieved in fiscal 2021-22.

- Engineering exports from India saw its all-time high five times in the last eleven fiscals.

- During 2024-25, engineering exports registered 6.74 percent year-on-year growth on its way to reach this record high. Exports were recorded at USD 109.30 billion in 2023-24.

- It is mention worthy in this regard that engineering exports outweighed the broader Merchandise Exports in terms of growth as India’s Merchandise exports saw a meagre 0.08 percent year-on-year growth in 2024-25 to reach USD 437.42 billion.

- As a consequence, share of engineering in India’s overall merchandise exports increased to 26.67 percent in 2024-25 from 25.01 percent in the previous fiscal.

- The performance of Indian engineering exports was really remarkable in 2024-25 as it came during a period of extreme global uncertainty following geo-political disturbances and economic slowdown in major developed and emerging nations, which was further aggravated by tariff escalation by the USA.

HIGHLIGHTS

- Despite achieving a record high figure in 2024-25, Indian engineering exports declined on a monthly basis in March 2025. Engineering exports in March 2025 was recorded at USD 10.82 billion as against USD 11.27 billion in March 2024, registering a decline of 3.92 percent year-on-year.

- According to the Quick Estimates of Department of Commerce, Government of India, share of engineering in India’s total merchandise exports increased to25.79 percent in March 2025 from 24.61 percent in February 2025. On a cumulative basis, the share was recorded at 26.67 percent during entire fiscal 2024-25 as against 25.01 percent in the previous fiscal.

- In March 2025, 27 out of 34 engineering panels witnessed positive year-on-year growth. While 13 engineering panels including mainly Iron and Steel and products, Copper, and products, Aircrafts and Spacecrafts, Ship and Boats, Cranes, Lifts Winches, Other Construction Machinery etc witness decline in exports during March 2025 vis-à-vis March 2024.

- On a cumulative basis, 28 out of 34 engineering panels recorded positive growth and remaining 6 engineering panels including Iron and Steel, some Non-ferrous sectors including Copper and Aluminium products, Office Equipment, Other Construction Machinery and Mica Products recorded negative growth during April-March 2024-25.

- Region wise, North America maintained itsspot as the number one export destination with a share of 20.5% followed by EU (17.1%) and WANA (16.7%) in March 2025. Significant export growth was noted in LAC (20.1%), Other Europe (19%) and NE Asia (14.1%), in March 2025. In cumulative terms, all regions experienced growth barring Oceania (-10.4%) and EU (-1.9%).

- Country-wise, USA remained the top destinations followed by UAE and Saudi Arabia in March 2025 while maximum increase was noted in France (43.2%), Nepal (37 %) andUK (32.9%).

- In cumulative terms too USA remained the number one destination. Significant export growth was noted in UAE, Sinagpore, Nepal, Japan and France.

| Trade Flow | Export in Mar 2024 | Export in Mar 2025 | Growth (%) | Exports in Apr-Mar 2023-24 | Exports in Apr-Mar 2023-24 | Growth (%) |

|---|---|---|---|---|---|---|

| Overall engineering exports | 11266.67 | 10824.55 | -3.92 | 109300.95 | 116670.03 | 6.74 |

| Engineering exports excluding Iron and Steel | 10109.34 | 10014.45 | -0.94 | 97441.59 | 107418.99 | 10.24 |

OVERALL ENGINEERING EXPORTS VS ENGINEERING EXPORTS EXCLUDING STEEL SEGMENT(Values in USD Million)

OBSERVATIONS: Excluding the export of iron and steel, engineering exports recorded a lower year-on-year decline on a monthly basisand a higher year-on-year growth on a cumulative basis as exports of Iron and Steel declined substantially on both estimates. In March 2025,exports of Iron and Steel declined by 30 percent while on a cumulative basis, the decline was 22 percent year-on-year for fiscal 2024-25.

ENGINEERING EXPORTS: MONTHLY TREND

The monthly engineering figures for 2024-25 vis-à-vis 2023-24 are shown below as per the latest DG CI&S estimates:

| Month | 2023-24 | 2024-25 | Growth (%) |

|---|---|---|---|

| April | 8949.36 | 8547.61 | -4.49 |

| May | 9310.92 | 9991.25 | 7.43 |

| June | 8515.72 | 9389.75 | 10.25 |

| April–June | 26765.71 | 27928.61 | 4.34 |

| July | 8720.30 | 9166.73 | 5.12 |

| August | 9048.65 | 9435.53 | 4.28 |

| September | 8866.54 | 9824.32 | 10.55 |

| July–September | 26655.49 | 28426.59 | 6.64 |

| October | 8078.48 | 11251.25 | 39.27 |

| November | 7822.25 | 8895.53 | 13.74 |

| December | 10007.56 | 10840.80 | 8.33 |

| October–December | 25908.29 | 30987.58 | 19.60 |

| January | 8768.87 | 9422.79 | 7.46 |

| February | 9936.92 | 9079.99 | -8.64 |

| March | 11266.67 | 10824.55 | -3.92 |

| January–March | 29971.46 | 29327.24 | -2.15 |

| April–March | 109300.95 | 116670.03 | 6.74 |

REGION WISE INDIA’S ENGINEERING EXPORTS

The following table depicts region wise India’s engineering exports for 2024-25 as compared to 2023-24.

Source: DGCI&S

Table 2: Region wise engineering exports in April-March 2024-25 vis-à-vis April-March 2023-24

| Region | March 2024 | March 2025 | Growth (%) | April–March 2023–24 | April–March 2024–25 | Growth (%) |

|---|---|---|---|---|---|---|

| NORTH AMERICA | 2085.0 | 2313.5 | 11.0% | 22072.2 | 23917.4 | 8.4% |

| EUROPEAN UNION | 2120.6 | 1767.6 | -16.6% | 20345.8 | 19960.3 | -1.9% |

| WANA | 2028.1 | 1755.5 | -13.4% | 16652.2 | 19503.1 | 17.1% |

| ASEAN | 1381.9 | 995.2 | -28.0% | 12139.8 | 12245.3 | 0.9% |

| N E ASIA | 743.2 | 848.1 | 14.1% | 8251.9 | 8766.7 | 6.2% |

| SSA (Sub Saharan Africa) | 829.9 | 879.5 | 6.0% | 8010.9 | 8759.8 | 9.3% |

| OTHER EUROPE | 609.0 | 724.8 | 19.0% | 6752.0 | 7553.6 | 12.7% |

| SOUTH ASIA | 672.9 | 615.8 | -8.5% | 6179.8 | 6489.4 | 5.0% |

| LATIN AMERICA | 501.3 | 602.0 | 20.1% | 5747.0 | 6186.0 | 7.6% |

| CIS | 153.5 | 164.8 | 7.3% | 1639.7 | 1848.5 | 12.9% |

| OCEANIA | 139.5 | 146.5 | 5.0% | 1537.8 | 1378.1 | -10.4% |

| OTHERS | 1.8 | 11.2 | 537.4% | 25.1 | 71.4 | 184.4% |

| Grand Total | 11266.7 | 10824.5 | -3.9% | 109301.0 | 116670.0 | 6.7% |

Source: DGCI&S

TOP 25 ENGINEERING EXPORT DESTINATIONS IN MARCH 2025

We now look at the export scenario of the top 25 nations that had highest demand for Indian engineering products during March 2025 over March 2024 as well as in cumulative terms during April-March 2024-25 vis-à-vis April-March 2023-24. The data clearly shows that top 25 countries contribute 73.3% of total engineering exports.

Table 3: Engineering exports country wise (Values in US$ million)

| Country | Feb-24 | Feb-25 | Growth (%) | Apr’23–Feb’24 | Apr’24–Feb’25 | Growth (%) |

|---|---|---|---|---|---|---|

| USA | 1671.90 | 1886.72 | 12.8% | 17624.33 | 19155.98 | 8.7% |

| UAE | 675.34 | 716.88 | 6.2% | 7964.84 | 8277.69 | 4.03% |

| SAUDI ARABIA | 604.19 | 451.39 | -25.3% | 5232.10 | 4954.29 | -5.3% |

| SINGAPORE | 350.79 | 334.61 | -4.6% | 3399.01 | 4469.31 | 31.5% |

| GERMANY | 394.24 | 401.34 | 1.8% | 3939.97 | 4033.68 | 2.4% |

| UK | 322.81 | 429.14 | 32.9% | 3591.99 | 4013.30 | 11.7% |

| MEXICO | 300.12 | 312.64 | 4.2% | 3249.10 | 3534.33 | 8.8% |

| TURKEY | 248.16 | 253.08 | 2.0% | 2751.61 | 3044.60 | 10.6% |

| ITALY | 366.26 | 261.23 | -28.7% | 3886.05 | 2988.63 | -23.1% |

| CHINA | 266.07 | 216.05 | -18.8% | 2651.09 | 2667.03 | 0.6% |

| KOREA RP | 203.99 | 262.14 | 28.4% | 2314.88 | 2597.11 | 12.2% |

| SOUTH AFRICA | 252.54 | 225.56 | -10.7% | 2192.73 | 2517.58 | 14.8% |

| FRANCE | 144.31 | 206.64 | 43.2% | 1954.59 | 2494.93 | 27.6% |

| JAPAN | 161.37 | 211.38 | 31.0% | 1924.73 | 2437.67 | 26.7% |

| NEPAL | 159.30 | 218.24 | 37.0% | 2060.73 | 2247.38 | 9.1% |

| BRAZIL | 259.07 | 214.88 | -17.0% | 2139.73 | 2187.82 | 2.3% |

| BANGLADESH | 225.02 | 214.86 | -4.5% | 2193.75 | 2187.68 | -0.3% |

| THAILAND | 139.68 | 181.69 | 30.1% | 1840.78 | 2005.25 | 9.0% |

| INDONESIA | 121.68 | 130.46 | 7.2% | 1804.08 | 1505.00 | -17.0% |

| NETHERLAND | 168.77 | 172.66 | 2.3% | 1891.75 | 1908.57 | 0.9% |

| MALAYSIA | 417.30 | 127.24 | -69.5% | 2318.09 | 1458.70 | -37.1% |

| VIETNAM | 157.38 | 139.17 | -11.5% | 1319.68 | 1435.26 | 8.7% |

| BELGIUM | 179.82 | 146.60 | -18.5% | 1723.72 | 1400.74 | -18.7% |

| SPAIN | 154.81 | 112.34 | -27.4% | 1595.86 | 1385.62 | -13.2% |

| RUSSIA | 132.11 | 113.27 | -14.3% | 1366.27 | 1263.64 | -7.6% |

| Total engineering exports to top 25 countries | 8012.04 | 7941.47 | -0.9% | 81946.85 | 87534.68 | 6.8% |

| Total engineering exports | 11266.67 | 10824.55 | -3.9% | 109300.95 | 116670.03 | 6.7% |

Source: DGCI&S

PANEL WISE INDIA’S ENGINEERING EXPORTS

| Product panels | March 2024 | March 2025 | Growth (%) | April–March 2023–24 | April–March 2024–25 | Growth (%) |

|---|---|---|---|---|---|---|

| Ferrous | ||||||

| Iron and Steel | 1157.3 | 810.1 | -30% | 11859.4 | 9251.0 | -22% |

| Products of Iron and Steel | 994.7 | 981.1 | -1% | 9892.7 | 10116.3 | 2% |

| Sub Total | 2152.0 | 1791.2 | -17% | 21752.1 | 19367.4 | -11% |

| Non-Ferrous | ||||||

| Copper and products | 243.2 | 205.9 | -15% | 2526.2 | 2320.5 | -8% |

| Aluminium and products | 577.5 | 655.0 | 13% | 7681.0 | 6890.2 | -10% |

| Zinc and products | 46.8 | 47.8 | 3% | 727.4 | 740.9 | 2% |

| Nickel and products | 20.4 | 21.2 | 4% | 167.5 | 190.5 | 14% |

| Lead and products | 101.1 | 108.9 | 8% | 780.5 | 945.7 | 21% |

| Tin and products | 1.9 | 3.2 | 71% | 5.2 | 7.4 | 42% |

| Other Non-Ferrous Metals | 70.4 | 86.0 | 22% | 748.1 | 870.3 | 16% |

| Sub Total | 1061.3 | 1144.8 | 8% | 12646.8 | 11980.7 | -5% |

| Industrial Machinery | ||||||

| Industrial Machinery like Boilers, parts, etc. | 84.4 | 101.4 | 20% | 741.6 | 853.8 | 15% |

| IC Engines and Parts | 334.3 | 396.0 | 19% | 3633.3 | 3891.7 | 7% |

| Pumps of all types | 139.6 | 142.5 | 2% | 1439.7 | 1549.5 | 8% |

| Air condition and Refrigerators | 187.5 | 220.2 | 17% | 1725.4 | 1964.5 | 14% |

| Industrial Machinery for dairy, food processing, textiles etc. | 812.3 | 893.3 | 10% | 8059.3 | 8856.5 | 10% |

| Machine Tools | 79.5 | 83.7 | 5% | 787.9 | 808.3 | 3% |

| Machinery for injecting moulding, valves and ATMs | 260.2 | 287.6 | 11% | 2530.6 | 2845.1 | 12% |

| Sub Total | 1898.2 | 2129.6 | 12% | 18847.9 | 20259.1 | 7% |

| Electrical Machinery | ||||||

| Electrical Machinery | 1201.8 | 1385.9 | 15% | 12370.9 | 14380.3 | 16% |

| Automobile and Auto Component | ||||||

| Motor Vehicle/cars | 741.7 | 911.1 | 23% | 8254.6 | 8990.5 | 9% |

| Two and Three Wheelers | 302.6 | 303.7 | 0% | 2772.4 | 3206.6 | 16% |

| Auto Components/Part | 716.1 | 784.3 | 10% | 5305.6 | 5336.1 | 1% |

| Auto Tyres and Tubes | 284.1 | 294.9 | 3% | 2889.5 | 3147.3 | 9% |

| Sub Total | 2065.5 | 2293.3 | 11% | 21618.5 | 23470.7 | 8.6% |

| Aircrafts and Related Products | ||||||

| Aircrafts and Spacecraft parts and products | 894.2 | 243.0 | -73% | 3242.7 | 6963.4 | 115% |

| Ships Boats and Floating products and parts | ||||||

| Ships Boats and Floating products and parts | 475.8 | 254.2 | -47% | 4059.5 | 4296.7 | 6% |

| Miscellaneous engineering products | ||||||

| Medical and Scientific instruments | 246.5 | 309.6 | 26% | 2428.1 | 2820.9 | 16% |

| Railway Transport | 24.3 | 28.1 | 16% | 315.3 | 357.1 | 13% |

| Hand Tools & Cutting Tools | 89.3 | 98.8 | 9% | 928.4 | 1040.5 | 12% |

| Bicycle & Parts | 36.7 | 46.6 | 27% | 364.6 | 410.7 | 13% |

| Cranes Lifts & Winches | 115.0 | 102.9 | -10% | 1097.9 | 1012.6 | -8% |

| Office Equipment | 31.6 | 31.7 | 0% | 312.9 | 288.0 | -8% |

| Other Construction Machinery | 331.4 | 300.9 | -9% | 3032.7 | 3027.4 | 0% |

| Prime Mica & Mica Products | 3.3 | 3.6 | 9% | 37.0 | 31.7 | -14% |

| Project Goods | 0.1 | 0.9 | 969% | 2.6 | 3.2 | 22% |

| Other Rubber Product Except Footwear | 165.4 | 171.6 | 4% | 1680.6 | 1778.4 | 6% |

| Other Misc. Items | 472.7 | 488.0 | 3% | 4597.1 | 5116.0 | 11% |

| Sub total | 1517.9 | 1582.7 | 4.3% | 14762.6 | 15952.5 | 8.1% |

| Total engineering exports | 11266.7 | 10824.5 | -3.9% | 109301.0 | 116670.0 | 6.74% |

Table 5: Panel-wise shares in India’s total engineering exports during April-March 2024-25

| Product panels | Share % (April–March 2023-24) | Share % (April–March 2024-25) |

|---|---|---|

| Electric machinery and equipment | 11.3% | 12.3% |

| Products of iron and steel | 9.1% | 8.7% |

| Iron and steel | 10.9% | 9.7% |

| Motor vehicles/cars | 7.6% | 7.7% |

| Industrial machinery for dairy etc. | 7.4% | 7.2% |

| Auto components/parts | 7.0% | 7.0% |

| Aircraft, spacecraft and parts | 3.0% | 6.0% |

| Aluminium, products of aluminium | 7.0% | 5.9% |

| Other miscellaneous engineering items | 4.2% | 4.4% |

| Ship, boat and floating structures | 3.7% | 3.7% |

| IC engines and parts | 3.3% | 3.2% |

| Two and three wheelers | 2.5% | 2.7% |

| Auto tyres and tubes | 2.6% | 2.6% |

| Other construction machinery | 2.8% | 2.4% |

| ATM, injection-moulding machinery etc. | 2.3% | 2.4% |

| Medical and scientific instruments | 2.2% | 2.4% |

| Copper and products made of copper | 2.3% | 2.0% |

| Product panels | Share % (April–March 2023-24) | Share % (April–March 2024-25) |

|---|---|---|

| AC, refrigeration machinery etc | 1.6% | 1.7% |

| Other rubber products except footwear | 1.5% | 1.5% |

| Pumps of all types | 1.3% | 1.3% |

| Cranes, lifts and winches | 1.0% | 0.9% |

| Hand tool, cutting tool of metals | 0.8% | 0.9% |

| Lead and products made of lead | 0.7% | 0.8% |

| Other non-ferrous metal and products | 0.7% | 0.7% |

| Nuclear reactor, industrial boiler, parts | 0.7% | 0.7% |

| Machine tools | 0.7% | 0.7% |

| Bicycle and parts | 0.3% | 0.3% |

| Railway transport equipment, parts | 0.3% | 0.3% |

| Office equipments | 0.3% | 0.2% |

| Nickel, product made of nickel | 0.2% | 0.2% |

| Prime mica and mica products | 0.0% | 0.0% |

| Tin and products made of tin | 0.0% | 0.0% |

| Project goods | 0.0% | 0.0% |

| Zinc and products made of zinc | 0.7% | 0.6% |

Reasons for Decline (As per April-March 2024-25):

1. Ferrous Products

- Export Performance

- Iron and Steel: Significant decline of 30% from March 2024 to March 2025, and a 22% decline from April-March 2023-24 to April-March 2024-25.

- Products of Iron and Steel: Slight decline of 1% from March 2024 to March 2025, but a 2% growth from April-March 2023-24 to April-March 2024-25.

- Overall Ferrous Products: Decline of 17% from March 2024 to March 2025, and an 11% decline from April-March 2023-24 to April-March 2024-25.

- US Tariffs: The 25% tariffs imposed by the US on steel imports ( as per the proclamation order dated on 18th March 2025) have created a challenging environment for Indian steel exporters. Although India’s direct steel exports to the US are relatively low, the tariffs have led to increased global competition and price pressures. The tariffs have also resulted in a shift in trade flows.

-

Impact of US Tariffs on India’s Steel Exports: (i) While the direct impact of US tariffs on India’s steel exports is limited due to the low volume of exports to the US, the indirect effects are significant. The tariffs have led to increased global competition and price pressures, affecting India’s export competitiveness (ii) India’s Directorate General of Trade Remedies (DGTR) initiated a 12% safeguard duty on a broad range of steel products for 200 days, starting from April 21, 2025. This measure aims to protect the domestic market from a surge in imports. While this move is intended to shield local producers, it has also led to increased costs for user industries, potentially impacting their competitiveness

- Overall price scenario in various countries post imposition of US tariff:

- i. US: The US imposed a 25% tariff on all steel imports, which has significantly boosted domestic steel prices. Hot-rolled coil (HRC) prices soared, with the Midwest HRC price averaging $807 per short ton in March, up from $698 in January. The tariffs have led to increased demand for domestic steel, extending delivery lead times and pushing up prices further. (Source: SPG Platts Connet)

- ii. China: The Chinese steel market experienced muted sentiment due to the US tariffs. Steel prices have remained relatively flat, with hotrolled coil prices averaging 3,419 yuan per metric ton in March 2025. The tariffs have created uncertainty, leading to cautious buying behavior and concerns about a potential trade war. (Source: SPG Platts Connet)

- iii.European Union: EU flat steel prices have risen due to expectations of tighter import quotas in response to the US tariffs and improving manufacturing activity. Northern EU flat steel prices reached a six-month high of €615 per metric ton in early March 2025. (Source: SPG Platts Connet)

- iv.Turkey: Turkey’s scrap prices have strengthened due to higher US steel and scrap prices. However, slow rebar sales have capped further gains.

- v. India: The Indian government has imposed a provisional 12% safeguard duty on specific non-alloy and alloy steel flat products, effective from April 21, 2025. This measure, following DGTR’s findings of a surge in imports causing harm to domestic producers, aims to protect local steel manufacturers. Exemptions apply to imports from developing countries (excluding China and Vietnam) and products priced above certain thresholds. The duty will be in effect for 200 days, providing temporary relief to stabilize domestic steel prices and support the industry.( Source: BigMint).

- 2. Non- Ferrous Sector (Copper and Aluminium)

Copper:

The copper exports declined by 15% in March 2025 and 8% in April-March 2024-25. The decline can be majorly attributed to India’s growing copper demand and its position as a net copper importer due to the shutdown of the Sterlite Copper plant in Tamil Nadu’s Tuticorin in 2018. As per the Ministry of Mines, India’s domestic demand for copper is expected to increased by 1.7 million tonnes by 2027.

Aluminium:

The Aluminium exports declined by 10% in April-March 2024-25. However, it exhibited growth of 13% in March 2025. The decline in aluminium can be attributed to the following reason - RODTEP benefit to SEZ units was only provided in October, November and December 2024 although the scheme was implemented from April 2024 for entire financial year. This is making exports unviable, and not competitive. Declining exports to the US due to the tariff situation is also a cause of concern

ENGINEERING EXPORTS STATE-WISE ANALYSIS

State wise engineering export performance

The table below indicates the exports from top Indian states. It is evident from the table that almost 94.7 % of India’s exports is contributed by the listed 12 states. Within this almost 56.5 percent of exports is done by Maharashtra, Tamil Nadu and Gujarat together.

Table 6:Top state wise engineering export performance – April-March 2024-25 (Values in USD Million)

| Top States | 2023-24 | 2024-25 | Growth % | % Share in India’s Eng Export | Remark |

|---|---|---|---|---|---|

| Maharashtra | 22992.9 | 22546.4 | -1.9% | 18.1% | 94.9% share covered by top 12 states |

| Tamil Nadu | 16844.6 | 18108.6 | 7.5% | 16.6% | |

| Gujarat | 14753.3 | 16590.5 | 12.5% | 7.5% | |

| Telangana | 3458.0 | 7536.2 | 117.9% | 7.3% | |

| Karnataka | 6709.1 | 7277.3 | 8.5% | 5.9% | |

| Odisha | 7125.2 | 5910.1 | -17.1% | 4.4% | |

| Uttar Pradesh | 4117.9 | 4348.7 | 5.6% | 4.3% | |

| Andhra Pradesh | 4885.6 | 4319.4 | -11.6% | 3.5% | |

| West Bengal | 3134.8 | 3523.7 | 12.4% | 2.0% | |

| Madhya Pradesh | 1849.6 | 2013.1 | 8.8% | 1.3% | |

| Rajasthan | 3405.3 | 1346.3 | -60.5% | 1.2% | |

| Daman & Diu and Dadra & Nagar Haveli | 1475.0 | 1242.0 | -15.8% | 22.6% |

Source: NIRYAT portal

- Top 12 states constitute over 94.9 % of India’s engineering Exports. Once again, Karnataka maintained its 5th position, Telengana retained its 4th position, Odisha maintaining its 6th position, West Bengal moving up to 9th position, while Daman and Diu remained at 12th position and Haryana moved down to 13th position during the fiscal April-March 2024-25 compared to the same period last fiscal.( as per estimates of Niryat Portal)

- Major negative growth witnessed in states like Maharashtra, Odisha, Andhra Pradesh, Rajasthan and Daman and Diu during April-March 2024-25 compared to the same period last fiscal.

- Maharashtra being the highest state in terms of Engineering Goods exports (constituting a share of 22.6%) is leading by US$ 4.44 billion from Tamil Nadu(Second Highest State) for the period of April-March 2024-25

INDIA’S REGION WISE ENGINEERING EXPORTS

In terms of region, western region which includes industrial states like Maharashtra and Gujarat is the front runner in terms of exports with 39.2 percent share. Tamil Nadu from the Southern Region has retained its export performance and it ranked second after Maharashtra, while Gujarat and Telengana ranked third and fourth during April-March 2024-25.

Note: Region wise estimates are yet to be uploaded due to some data discrepancy in Niryat Portal.

Note: The total engineering exports given in the above table is taken from NIRYAT as per the latest available data and may not tally with the total engineering exports as given by DGCI&S.

CORRELATION BETWEEN MANUFACTURING PRODUCTION AND ENGINEERING EXPORTS

Engineering forms a considerable part of the broader manufacturing sector and the share of engineering production in overall manufacturing output is quite significant. As exports generally come from what is produced within a country, some correlation between manufacturing production growth and engineering export growth should exist. We briefly look at the trend in manufacturing growth as also engineering export growth to see if they move in tandem. It may be mentioned that manufacturing has 77.63% weightage in India’s industrial production.

Engineering export growth and manufacturing output growth moved in the same direction in as many as nine out of twelve months in each of the fiscal years 2019-20 and 2020-21. During fiscal 2021 22, engineering export growth and manufacturing growth moved in the same direction in seven out of twelve monthswhile in each of fiscal 2022-23 and 2023-24, as many as 10 out of 12 months saw engineering exports and manufacturing output moved in the same direction.

The first two month of fiscal 2024-25 also saw manufacturing output growth and engineering exports growth moving in the same direction. April 2024 saw engineering exports declined from a growth in Mar 2024 and manufacturing output growth decelerated. The month of May 2024 witnessed just the opposite. Engineering exports bounced back to growth path and manufacturing output growth accelerated. Then June and July2024 however saw both moved in the opposite direction but August 2024 saw both engineering export growth and manufacturing growth slowing down.September and October 2024 again saw both moving in the same direction by securing acceleration in growth. November 2024 however saw slowdown in engineering export growth but faster manufacturing growth vis-à-vis October 2024 while growth in both engineering exports and manufacturing output moderated in December 2024. In January 2025 once again, the direction was opposite but in February both moved in the same direction as engineering exports declined and manufacturing growth moderated.

The link between these two may not be established monthly, but a positive correlation may be seen if medium to long term trend is considered.

Table 7: Engineering exports growth vis-à-vis manufacturing growth from April 2022

| Months / Year | Engg. Export Growth (%) | Manufacturing Growth (%) |

|---|---|---|

| April 2023 | -7.52 | 5.5 |

| May 2023 | -4.25 | 6.3 |

| June 2023 | -11.12 | 3.5 |

| July 2023 | -6.91 | 5.3 |

| August 2023 | 7.66 | 10.0 |

| September 2023 | 6.50 | 5.1 |

| October 2023 | 6.99 | 10.6 |

| November 2023 | -3.48 | 1.3 |

| December 2023 | 9.82 | 4.6 |

| January 2024 | -4.10 | 3.6 |

| February 2024 | 15.90 | 4.9 |

| March 2024 | 10.66 | 5.9 |

| Months / Year | Engg. Export Growth (%) | Manufacturing Growth (%) |

|---|---|---|

| April 2024 | -4.49 | 4.2 |

| May 2024 | 7.43 | 5.1 |

| June 2024 | 10.26 | 3.5 |

| July 2024 | 5.12 | 4.7 |

| August 2024 | 4.28 | 1.2 |

| September 2024 | 10.55 | 4.0 |

| October 2024 | 39.27 | 4.4 |

| November 2024 | 13.72 | 5.5 |

| December 2024 | 8.33 | 3.4 |

| January 2025 | 7.49 | 5.8 |

| February 2025 | -8.64 | 2.9 |

Source: (Source: Department of Commerce and CSO)

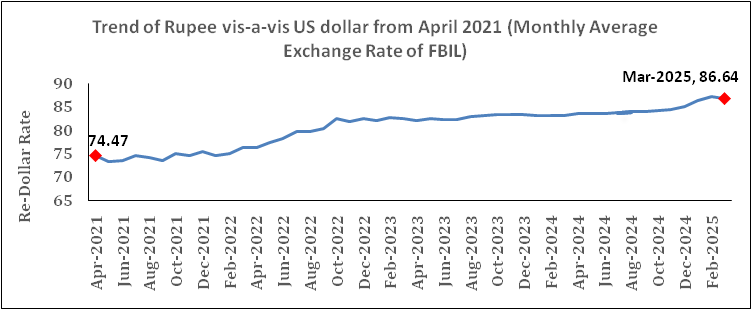

IMPACT OF EXCHANGE RATE ON INDIA’S EXPORTS

How did the exchange rate fare during March 2025 and what was the recent trend in Re-Dollar movement? In order to get a clearer picture of the recent Re-Dollar trend, not only we took the exchange rate of March 2025, but also considered monthly average exchange rate of Rupee vis-à-vis the US Dollar for each month of fiscal 2023-24 and 2024-25 as per the latest data published, as mere one-month figure does not reflect any trend. The following two tables clearly depicts the short-term trend:

Rupee appreciated over the month in March 2025 for the first time after September 2024 but depreciation continued on a year-on-year basis: INR appreciated vis-à-vis the US Dollar by 0.47 percent in March 2025 over the previous month as reciprocal tariff imposed by the USA has created panic about the US economic prospect in the short term leading to weakening of dollar. On a year-on-year basis however, rupee continued to weaken.

Outlook: Currency market may remain volatile till a stability is seen in tariff war and rupee may witness mild gains in the near term.

Table 8: USD-INR monthly average exchange rate in 2024-25 vis-à-vis 2023-24 (As per latest data released by FBIL)

| Monthly Average Exchange Rate (1 USD to INR) | Year-on-Year Change (%) | Direction | Month-on-Month Change (%) | Direction | ||

|---|---|---|---|---|---|---|

| Month | 2023-24 | 2024-25 | ||||

| April | 82.02 | 83.41 | 1.69 | Depreciation | 0.49 | Depreciation |

| May | 82.34 | 83.39 | 1.28 | Depreciation | -0.02 | Appreciation |

| June | 82.23 | 83.47 | 1.51 | Depreciation | 0.10 | Depreciation |

| July | 82.15 | 83.59 | 1.75 | Depreciation | 0.14 | Depreciation |

| August | 82.79 | 83.89 | 1.33 | Depreciation | 0.36 | Depreciation |

| September | 83.05 | 83.92 | 1.04 | Depreciation | -0.10 | Appreciation |

| October | 83.21 | 84.02 | 0.94 | Depreciation | 0.25 | Depreciation |

| November | 83.30 | 84.36 | 1.27 | Depreciation | 0.40 | Depreciation |

| December | 83.28 | 84.99 | 2.05 | Depreciation | 0.75 | Depreciation |

| January | 83.14 | 86.27 | 3.76 | Depreciation | 1.51 | Depreciation |

| February | 82.96 | 87.05 | 4.93 | Depreciation | 0.90 | Depreciation |

| March | 83.00 | 86.64 | 4.39 | Depreciation | -0.47 | Appreciation |

Table 9: USD-INR monthly average exchange rate in 2023-24 vis-à-vis 2022-23 (As per latest data released by FBIL)

| Monthly Average Exchange Rate (1 USD to INR) | Year-on-Year Change (%) | Direction | Month-on-Month Change (%) | Direction | ||

|---|---|---|---|---|---|---|

| Month | 2022-23 | 2023-24 | ||||

| April | 76.17 | 82.02 | 7.68 | Depreciation | -0.33 | Appreciation |

| May | 77.32 | 82.34 | 6.49 | Depreciation | 0.39 | Depreciation |

| June | 78.04 | 82.23 | 5.37 | Depreciation | -0.13 | Appreciation |

| July | 79.60 | 82.15 | 3.20 | Depreciation | -0.10 | Appreciation |

| August | 79.56 | 82.79 | 4.06 | Depreciation | 0.78 | Depreciation |

| September | 80.23 | 83.04 | 3.50 | Depreciation | 0.30 | Depreciation |

| October | 82.40 | 83.21 | 0.98 | Depreciation | 0.24 | Depreciation |

| November | 81.81 | 83.30 | 1.82 | Depreciation | 0.07 | Depreciation |

| December | 82.46 | 83.28 | 0.99 | Depreciation | -0.02 | Appreciation |

| January | 81.90 | 83.14 | 1.49 | Depreciation | -0.17 | Appreciation |

| February | 82.61 | 82.96 | 0.42 | Depreciation | -0.19 | Appreciation |

| March | 82.29 | 83.00 | 0.86 | Depreciation | 0.05 | Depreciation |

Fig 2: Trend of Rupee vis-a-vis US dollar from April 2020 (Monthly Average Rate of FBIL has been considered)

ANALYSIS OF INDIA’S ENGINEERING IMPORTS

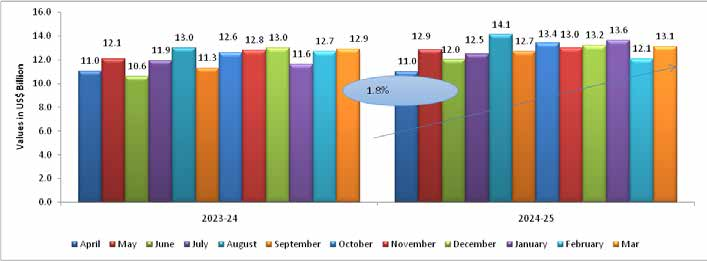

India’s Engineering imports during March 2025 were valued at US$ 13137.07 million compared to US$12907.84 million in March 2024 registering a positive growth of 1.8 percent in dollar terms. Barring Transport Equipments, all the sectors witnessed a rise in import during March 2025 compared to March 2024 registering positive growth over the same period.

The share of engineering imports in India’s total merchandise imports in March 2025 was estimated at 20.7 percent, lower than that of March 2024 which was estimated at 22.6 %. The figure below depicts engineering imports for March 2025 compared to March 2024.

Table 10: India’s engineering imports in April-March 2024-25 vis-à-vis April-March 2023-24

| Values in US$ MN | March 2024 | March 2025 | Growth % | April–March 2023–24 | April–March 2024–25 | Growth % |

|---|---|---|---|---|---|---|

| India’s Engineering Imports | 12907.84 | 13137.07 | 1.8% | 145591.97 | 153519.30 | 5.4% |

Source: Quick Estimates, MoC

Fig 3: Monthly Engineering Imports for April-March 2024-25 vis-a-vis April-March 2023-24

Source: EEPC India analysis

TREND IN ENGINEERING TRADE BALANCE

We now present the trend in two-way yearly trade for the engineering sector for the 2024-25 depicted in the table below:

Table 11: Monthly Trend in Engineering Trade Balance for the current FY 2024-25 (US$ Billions)

| Trade Flow | April | May | June | July | August | September | October | November | December | January | February | March |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Engineering Export | 8.7 | 10.0 | 9.4 | 9.0 | 9.4 | 9.8 | 11.2 | 8.9 | 10.6 | 9.4 | 9.1 | 10.8 |

| Engineering Import | 11.0 | 12.9 | 12.0 | 12.5 | 14.1 | 12.7 | 13.4 | 13.0 | 13.2 | 13.6 | 12.1 | 13.1 |

| Trade Balance | -2.3 | -2.9 | -2.6 | -3.5 | -4.7 | -2.9 | -2.2 | -4.1 | -2.4 | -4.2 | -3.0 | -2.3 |

Source: DGCI&S, EEPC India Analysis